It’s okay to admit it: you’ve heard it all over, dropped it in networking chats casually, and pretended you know exactly what it means. That’s okay. But from this point forward, no more nodding along. In the financial service industry, it’s critical to start with a clear definition of what open banking is and what it does to your existing business model.

Defining open banking

Open banking is, in many ways, synonymous with the use of APIs, or application programming interfaces. It means financial services institutions are using open APIs to foster third-party development of applications, encourage more open-source technology, and increase overall transparency for account owners. For banking data specifically, the use of APIs means that information is going to be more instantly accessible to consumers, speeding up transactions and investment moves.

Other implications of open banking include more transparency into historical data, faster determination of borrower risk level, more personalized information for financial decisions, and—ideally—an overall improved experience for consumers based on data that is more connected and free-flowing than ever before.

Another common aspect of the open banking definition, and perhaps the one more commonly referred to in your water cooler chats, is the understanding that it’s imperative to adopt it if your organization intends to stay competitive. Fintech startups are already using open banking to grab a slice of the consumer market, and it’s working. Traditional banks have to pause and consider how they can also take advantage of open banking’s possibilities, going from one-off transactional interactions with their customers and evolving into more relationship-oriented, long-lasting engagements.

Ultimately, at its core, open banking is about making consumer information, and thus the consumer experience, easier and more accessible.

What open banking can do for your traditional lines of business

“Open banking is about making everything for sale,” according to Kristin Moyer, Vice President of Research and Distinguished Analyst at Gartner. For traditional banks, this means “a new way to increase digital revenue for the banks that are willing to think differently about what it means to be a bank.”

Banking institutions must begin to view their information as not just theirs but as an asset to profit off of in secure but open API relationships. This is how new revenue streams will be unlocked as traditional banks break into the digital channels where consumers are spending more and more of their time and expecting more financial freedom to be available to them. Increasing digital revenue by making more things for sale is one of the biggest draws involved in open banking.

But open banking isn’t just about creating net new offerings or revenue streams—though that is a large and compelling use case for the technology. Open banking can also enhance your existing products and services by improving the speed of data, the fullness of data transparency, and improving customer engagement with more relevant information always at the ready.

You can extend your current offerings in a plug-and-play manner by simply opening up your APIs, the basic technical maneuver behind open banking—but you must know you also open doors for other fintech organizations to leverage your data when you take this step. This is why it’s critical to be ready to leverage all the benefits and possibilities of open banking to stay innovative from the start and develop your own new revenue streams with original offerings.

There’s open banking—and then there’s your open banking strategy

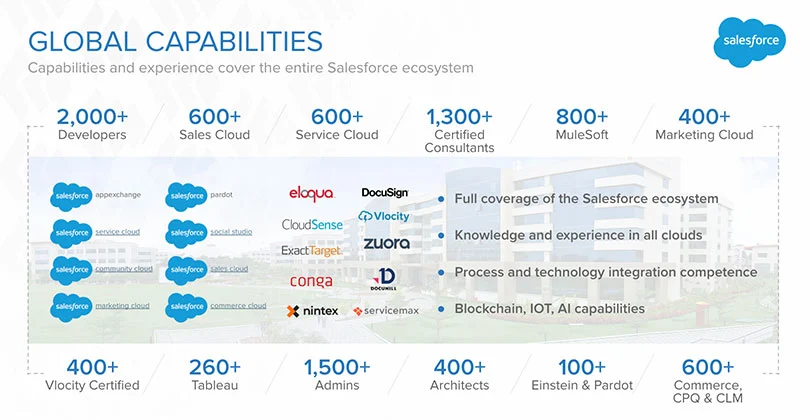

Defining open banking is one thing. But defining your company’s overarching approach to open banking and what that will look like for your organization is entirely separate. At Simplus, we call this developing your open banking strategy. It’s the way your organization intends to approach the inevitable and establish goals for how your organization can best leverage open APIs to either improve existing offerings or open up new ones—or both.

However, one of the first hesitations banking institutions have before starting their own open banking strategy is security. How can increasing transparency and data accessibility possibly be a good idea in such a regulated industry? While it’s true that the regulatory climate regarding open banking is ever-evolving and pending further development, especially in the United States, it doesn’t mean getting your foot in the door now is impossible. In fact, it’s all the more reason to start now so you can be a player that helps inform regulatory developments.

Open banking’s openness is not designed to contaminate and exploit consumer data in the financial industry. On the contrary, it’s intended to empower consumers by providing more accurate information with greater speed. Understanding this intention is the first step in developing your organization’s open banking strategy, so you can then begin to answer the main question: how can more accessible data be secure, compliant, and improve your business?

Done properly and with expert partners, open banking initiatives can improve transactional security and mitigate threats like screen scraping. Customers authorize the data they want to share and a secure data exchange occurs through the open API, creating a symbiotic relationship between the bank, the third parties, and the consumers. That’s why the value of a secure, open API is tremendous because it opens possibilities for more revenue while still keeping your organization dependable and compliant with all necessary regulatory requirements.

To ensure your open banking strategy balances these two, seemingly contradictory, API goals—secure and open—partnering up with the right vendors and consultants will be imperative. Our next chapter will shed more light on selecting and forming the right relationships for your open banking strategy.

0 Comments