In recent months, companies have been gearing up for a fundamental change in how they account for revenue: The new revenue recognition standard is known as ASC 606 in the United States, or IFRS 15 elsewhere around the world.

Companies across all industries have been asking us what ASC 606 compliance means for them and what they need to know. To address these questions, we have partnered with Simplus’s CPQ implementation specialists to put together this multi-part blog series. In this article—the first of five—we will explore five essential things that every company with complex revenue recognition processes should understand to achieve compliance:

1. Revenue recognition is moving farther up the sales pipeline: in traditional revenue operations, revenue recognition is driven by orders and invoicing schedules relatively late in the sales pipeline. Conversely, ASC 606 requires revenue to be considered much earlier, at the stage where agreements and quotes are generated for contracted pricing. This change in philosophical approach has significant ripple effects for how revenue recognition data should be recorded both in your CRM and on your accounting ledgers.

2. Goods and services need to be delivered to the customer before revenue can be recognized: A core principle of ASC 606 is that companies should not recognize revenue until goods and services have been delivered to the customer. This requires you to identify what exactly constitutes a contract. For example, it could be an explicit customer quote, or it could be a negotiated contract document. Once you define what a contract is, you will be able to decide when the transfer of goods and services to your customers is actually occurring.

3. Recognized revenue must reflect the actual consideration to which your company is entitled: When you recognize revenue, ASC 606 requires you to do so in a way that reflects the total consideration you actually expect to receive from the delivery of goods and services. This recognition process can get very tricky very quickly, especially if your pricing is set through subscriptions, multi-year contracts, and recurring revenue relationships.

4. Legacy ways of structuring deals and discounts may not be compatible: The contracts you are accustomed to are not necessarily compatible with ASC 606 revenue recognition standards. Indeed, many companies have built their deals and structured their discounts in ways that do not allow the accounting department to readily recognize revenue derived from the transfer of goods and services to the customer—nor to do so in amounts that can be linked to the actual consideration to which the company is entitled.

4. Legacy ways of structuring deals and discounts may not be compatible: The contracts you are accustomed to are not necessarily compatible with ASC 606 revenue recognition standards. Indeed, many companies have built their deals and structured their discounts in ways that do not allow the accounting department to readily recognize revenue derived from the transfer of goods and services to the customer—nor to do so in amounts that can be linked to the actual consideration to which the company is entitled.

5. Systems built for one-time sales transactions are unlikely to be helpful: As your Customer Relationship Management (CRM) needs have evolved, you have no doubt developed ad-hoc solutions that build upon and adapt the base systems you’ve had for years. In many cases, these base systems were built for one-time transactions; then, you customized the systems with workarounds to accommodate your changing business model. With the advent of ASC 606, systems originally built for one-time transactions are unlikely to be able to make the transition. You need a modern CPQ (configure, price, quote) system like Salesforce CPQ that can be easily configured to properly manage the treatment of revenue in compliance with ASC 606.

The new ASC 606 compliance standards will be challenging for many businesses, but they also can be advantageous. The changes you’ll be required to make under ASC 606 will force you to revisit and overhaul aspects of your sales cycle that may not be as efficient or as connected as it should.

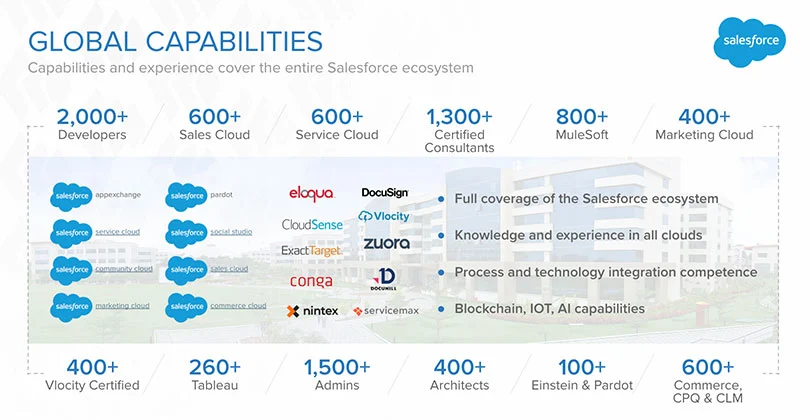

To learn more about ASC 606 and how you can use the powerful capabilities of Salesforce to automate and streamline your ASC 606 compliance obligations, reach out to us at Simplus today.

0 Comments