Tech companies are spending far more time on manual reconciliation than they should be. And the reason is simple: The industry isn’t using the right tools. In a recent survey examining account reconciliation practices in business, just four percent of respondents reported that they use specialized IT tools to prepare consolidated financial statements, according to the Business Application Research Center. Modern IT tools are necessary to create a unified, interconnected revenue ecosystem that brings together disparate parts of the organization, especially sales, operations, finance, and IT.

In the absence of modern, well-architected IT tools for managing financial reconciliation activities, tech companies tend to let sales and operations chart their own course to revenue and profitability—with little regard for how it complicates and obfuscates downstream revenue reconciliation activities. In fact, it’s common for finance teams to spend copious and unnecessary amounts of time ensuring their records reflect what actually has been sold, contracted, fulfilled, and adjusted. Fortunately, the advent of modern revenue operations systems means that IT can play a central role in helping tech companies reimpose order and control over their financial reconciliation activities. Let’s explore four ways the tech industry can put an end to needless time wasted on manual reconciliation:

Streamline your product catalog

Tech companies spend copious time on manual reconciliation due to their CRM system being out of sync with their ERP and accounting systems. One of the main reasons for this disconnect is the simple fact that companies don’t understand how these systems relate to the company’s own product catalog. Each product type has its own revenue operations-based sequence of events that controls how money flows through it. When tech companies understand how their CRM, ERP, and accounting systems interact with their product catalog, they can intelligently redesign their product catalog. More significantly, they can readily identify opportunities to simplify and streamline their product sets.

Walk in the footsteps of finance

In the average tech company, the finance team is perpetually going behind sales and fixing processes or revising previously completed actions around new products, new pricing, and new bundles to ensure everything is captured in the right way. The reality is that new offerings are rarely integrated in a logical, optimized fashion with downstream reconciliation processes. That’s why finance knows and has to take extra time to prepare for what’s coming down the pike. Instead of accepting dissatisfactory or suboptimal processes, tech companies—especially IT—can and should be taking time to walk in the finance team’s footsteps. Better than anyone else finance understands the relationship between how products are packaged and sold, and how the revenue from these sales is reconciled. When prompted, finance can pinpoint where time is needlessly wasted, where avoidable bottlenecks are occurring, and how to update workflows and systems in response to new offerings more efficiently.

Redesign reconciliation for the most complex contracts

When finance teams are tasked with reconciling revenue from complex contracts, they typically must review the contract line by line, manually reconstructing how the sales team architected the contract’s terms. Perhaps a subscription renewal discount was offered, the product package was altered, the customer was offered a proration, or the payment terms were updated. No matter what, it’s finance’s job to determine from the contract what actions need to be taken from an invoicing, revenue recognition, and accounting perspective. Consequently, complex contracts can and should be a focal point for tech companies looking for opportunities to streamline and eliminate manual reconciliation processes. More importantly, complex contracts serve as real-world opportunities to stress-test next-generation, IT-based solutions for optimally managing the entire revenue operations lifecycle.

Eliminate siloed systems

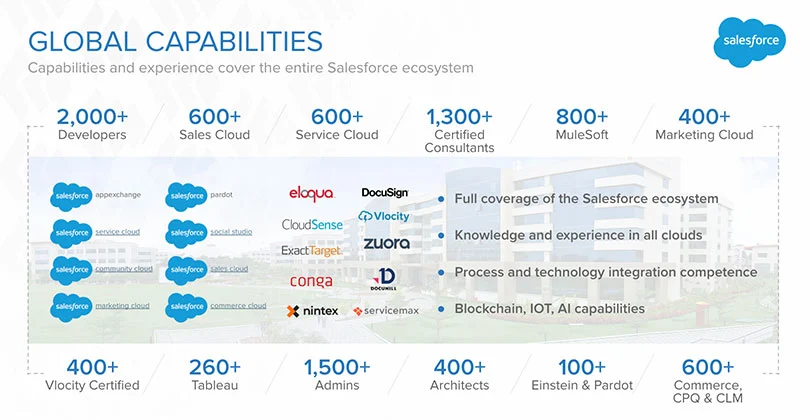

Every time data must be passed from one system to another, it increases the chances that the data won’t transmit properly, will get lost, or will be misread and misused by a downstream system. This is precisely how tech companies end up with CRM, ERP, and accounting systems that are siloed and disconnected from one another. They become reliant on manual, time-consuming processes to reconcile all of these issues. The solution is for IT to focus on replacing these siloed systems with modern, unified systems that produce and receive data designed to be seamlessly integrated. At Simplus, we specialize in helping tech companies eliminate their manual reconciliation processes using Salesforce Revenue Cloud, which seamlessly integrates with Salesforce CRM and most ERP systems.

Many tech companies waste unnecessary time with manual reconciliation activities. To streamline and automate these activities, it’s essential to look for ways to streamline and simplify your product catalog, learn from and walk in the footsteps of finance, redesign reconciliation for the most complex contracts, and replace siloed CRM, ERP, and accounting systems with modern, unified systems.

Streamlining financial recognition benefits more than just finance; it’s a win-win investment that helps the entire organization to optimize its revenue streams. To learn more about how Salesforce Revenue Cloud can help your organization rearchitect and reimagine reconciliation, please reach out to Simplus today. We look forward to showing you how to take full advantage of Salesforce’s revolutionary Revenue Cloud ecosystem.

0 Comments