Keeping up with the Joneses is what it’s all about in our fast-paced business world. And in the world of financial service reps, it’s no secret that keeping up-to-date with the Joneses is what it’s really all about. To stay competitive, you almost need to know more about your customers than they know about themselves.

A daunting task, especially with the advent of artificial intelligence algorithms and analysis platforms. And then there’s online everything. Most people prefer doing business online, and they love automation too. Not only that, they need to trust you and your technology with their personal information. And they expect all this in a seamless package.

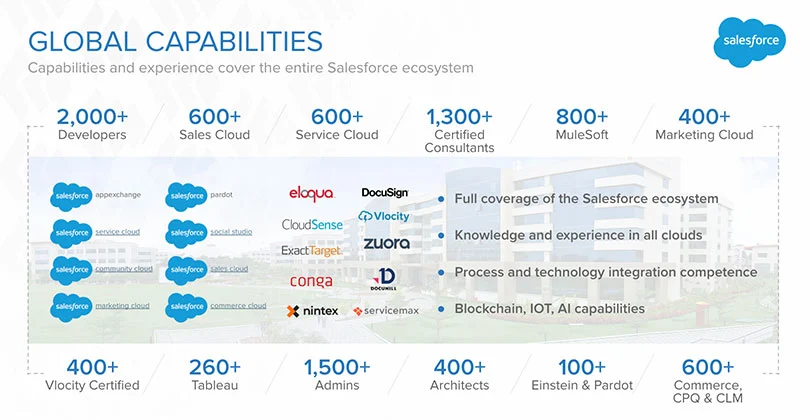

That’s a lot of expectations for a financial services rep to live up to. Thankfully, there’s the Salesforce Service Cloud to help ease the pains, and we at Simplus have five secrets to success with Service Cloud that every financial service rep will be thanking their lucky stars for.

Say hello to HAL, I mean, AI

If you’ve ever seen ‘2001: A Space Odyssey, you’ll remember HAL, a heuristically programmed algorithmic computer. HAL wasn’t a very good sentient computer. He took over the spacecraft and almost killed our hero, Dave. Not a pleasant introduction to artificial intelligence (AI), but it did start some AI awareness.

Back then, AI was science fiction—today, it’s science fact, especially when it comes to financial services. It’s been predicted that by 2030, financial services companies might save more than a trillion dollars by investing in AI technologies. Keeping up with the evolution of AI is menacing at best, but not with the Salesforce Service Cloud and its Einstein analytics solution.

Einstein is an advanced AI-powered platform that helps your managers manage their agents who serve your customers at any time, from anywhere via any device. AI is all about improving customer satisfaction. Salesforce Einstein uses AI technologies to help you automate reports, improve workflows, and analyze your customer service reps’ effectiveness.

Leverage multiple online channels

Everyone is online. We don’t go anywhere without our smartphones. It’s a fact of modern life. When it comes to banking, 40 percent of America is doing it online. And mobile banking is the preferred method for the 18 to 44 consumer demographic.

Salesforce Service Cloud provides a consistent and convenient banking experience on multiple online platforms, including social, web, text, email, phone calls, and even self-service portals. The Service Cloud Chat platform works on any device and is customizable to meet your needs. Chat request questions are even routed to the right agent to ensure the correct response in real-time.

Additionally, your reps are automatically fed links to relevant article references and prepared responses to help them better serve their customers. The agent console lets your reps manage concurrent chats. Also, your reps’ managers can monitor all chats in a live setting with customizable supervisor dashboards.

Automate as much as possible

The days of performing menial tasks are almost over in our digital environments. If it can be automated, it probably already has. In the financial services sector, a big part of a reps’ day is spent resolving routine issues like checking claims status or modifying orders. Einstein for Service lets you configure and deploy a self-service feature for your customers that’s automated and effortless.

Using Einstein Bots—Salesforce chatbots do many of these labor-intensive tasks automatically using natural language processing in real-time in chat sessions or via messaging. Your reps and managers are basically just overseeing Einstein in action.

You can even combine your business rules and the Einstein Next Best Action feature to deliver recommended actions to your service reps in real-time. Automation is about saving time and effort and the Salesforce Service Cloud brings self-service automation technology to the forefront.

Develop stronger trust

When the financial crisis of 2008 hit, the economy nearly collapsed and millions of Americans lost their homes while unemployment lept to almost 10 percent. The people’s trust in financial institutions suffered irreparable damage mainly because everyday Americans were left holding the bag, essentially funding a $700 billion bailout. Not to mention, the fact that people’s personal financial information still gets hacked all the time, in every business sector, including huge financial institutions.

To regain some of that trust, Salesforce Shield offers state-of-the-art data compliance features by providing data encryption and event monitoring. Shield also protects your customers’ sensitive data from hackers on the outside and unauthorized user access on the inside, meeting all the data compliance policies required by law. Your service reps can now offer your customers this new level of trust.

Utilize a seamless customer experience

The Salesforce Service Cloud provides a virtually seamless experience for both your reps and the customers they serve. And for today’s millennial customers, it seems to be all about having a comfortable, convenient experience.

In the financial services arena, putting customer satisfaction first is the future of customer service. And Salesforce is leading the way in CRM satisfaction. Salesforce Service Cloud provides the protection your reps need to weather the financial service storms both now and in the future.

0 Comments