Companies that invest in transformational change expect transformational revenue growth. Unfortunately, the majority of these companies fail to get the results they count on. Half of all organizational change initiatives fail, and only 34 percent are a clear success, according to Gartner industry research. While businesses invest in organizational transformation for a multitude of reasons, a common goal of these change initiatives is to bring sales and finance into closer alignment—especially when their disconnect can drag down revenue growth.

In many organizations, sales and finance teams operate on different wavelengths and, not surprisingly, are focused on executing their own priorities. They may not be considering how the other’s KPIs intersect with or impact their own. Sales teams want to close deals as fast as possible, which can worry finance approval teams. On the other hand, finance has critical approval and reconciliation procedures it wants to see followed. Fortunately, organizational transformation can bring these priorities into alignment and promote cooperation and collaboration. Let’s explore five best-practices strategies for bringing sales and finance together to optimize revenue growth:

Break down barriers to sharing data

In most organizations, sales and finance teams use completely different systems that don’t connect or integrate seamlessly. For example, finance may work with a billing system designed to handle invoicing and payments, but this system may not be able to manage orders and track customer purchases like the system that sales uses. With no seamless integration for their systems, sales and finance teams must constantly cross-reference and re-enter data manually. This cumbersome task breeds frustration and can lead to mistakes. Thus, an important first step to aligning sales and finance is to enable all data to be continuously and automatically shared. Under a revenue operations model, data that gets entered into the finance team’s systems seamlessly and automatically populates into the sales team’s systems—and vice versa. In this way, companies can consistently share data across CPQ, billing, customer lifecycle management, and ERP systems.

Continuously extract business intelligence from shared data

When sales and finance teams share their data automatically, the benefits extend beyond just improving data visibility for each team’s convenience. Shared data also provides a strategic opportunity for sales and finance teams to stabilize and grow revenue. When business intelligence is continuously and automatically served up, sales and finance gain insights into customer behaviors, buying patterns, and revenue forecasts. Sales and marketing specifically can immediately use these insights to collaboratively redesign and optimize buyer journeys, as well as conceptualize new marketing initiatives.

Identify optimal pricing

One of the best ways that sales and finance can collaboratively use shared data is to identify the best pricing opportunities. When finance can supply valuable data to create more comprehensive customer profiles, sales can use these customer insights to better understand customer needs and priorities, and ultimately engage in more intelligent customer targeting. Meanwhile, finance becomes a more direct player in driving new revenue opportunities. Thus, these new opportunities become a win-win situation for both sales and finance.

Automate low-value approvals and reconciliation processes

Finance teams are responsible for ensuring every I is dotted and every T is crossed during a sale. That means finance teams must often impose approvals processes that feel time-consuming and cumbersome to sales teams, and mandatory data reconciliation processes that suck up valuable time for both teams. Thus, it’s essential to look for ways to automate these low-value processes. For example, suppose a company requires all quotes that include discounts and block pricing to go through finance for internal approvals first. In that case, the company can instead write rules that enable sales to get the quote automatically reviewed and approved—as long as it falls within a predetermined set of pricing rules and guidelines. Similarly, manual data reconciliation and order transcription processes can all be made automated, enabling sales and finance alike to focus on higher-value work.

Use defined rules to impose quality-control standards

In many organizations, finance teams’ relationship with sales is strained by the perpetual oversight and accountability role that finance takes on relative to sales. The reality is that finance must guard against mistakes and sales decisions that could unintentionally expose the company to revenue loss. Thus, instead of finance constantly being forced to come down on sales for mistakes and problems with contracts, it’s important to instead develop defined business rules (i.e., around margin, discounting, approvals) that enable sales teams to validate their own work automatically. These rules, which are based on standardized data, give finance teams peace of mind that all sales activities are compliant with quality-control standards and that revenue margins are protected.

Getting sales and finance teams to work together—and even to see eye to eye—can feel like an overwhelming task. Fortunately, there are multiple steps that organizations can take to better align sales and finance, including breaking down barriers that are preventing data sharing, continuously extracting business intelligence from shared data, using shared data to identify optimal pricing opportunities, automating low-value manual processes that create friction and waste time, and using defined rules to impose necessary quality-control standards automatically.

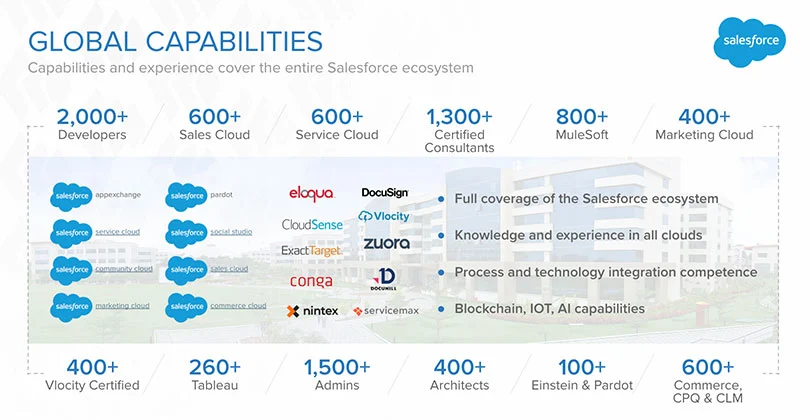

To achieve the strategic organizational changes necessary to bring sales and finance together, businesses turn to Salesforce Revenue Cloud, a single, highly interconnected revenue system that unifies sales, finance, and other teams around shared opportunities to optimize revenue. Simplus specializes in helping companies implement Revenue Cloud to optimize the working relationship between sales and finance. To learn more about how Simplus can revamp your lead-to-revenue architecture, please reach out to Simplus today.

0 Comments