Every year, it becomes more important for businesses to invest in enhancing their online sales capabilities. E-commerce sales made up 21 percent of all retail sales in 2020—up from 16 percent in 2019 and 14 percent in 2018, according to industry research by Digital Commerce 360. A big part of the online sales experience is creating a smooth, seamless payment experience for customers online. Fortunately, modern cloud commerce environments like Salesforce have been specifically designed to give businesses the tools and features they need to offer robust online payment capabilities.

When businesses choose Salesforce to supercharge their payment capabilities, one of the most important decisions they make is which payment gateway to integrate with Salesforce’s Billing platform. Payment gateways are third-party systems that connect Salesforce Billing to payment processing networks, including credit card companies. Thus, payment gateways play a critical intermediary role. And for better or worse, payment gateways are not all created equal. Thus, it’s important to understand what distinguishes mediocre payment gateways from exceptional ones. Let’s explore four key considerations every business should keep in mind when choosing a payment gateway that integrates with Salesforce:

Is the payment gateway designed specifically to integrate with Salesforce?

Payment gateways existed long before Salesforce and the Salesforce Billing platform. Although many payment gateways can be integrated with Salesforce, that doesn’t necessarily mean they were natively built to be integrated. Thus, a foundational first step when evaluating payment gateways is to verify that they are fully and seamlessly compatible with Salesforce. That means the payment integration needs to be able to readily send Salesforce all relevant payment records; it’s this transfer of payment data for every transaction that enables your Salesforce platform to serve as your organization’s centralized source of truth for all sales transactional data, including payment records.

Is it scalable to support your future growth?

Traditional payment gateways were designed to process only basic payment transactions in a limited number of countries. As the global e-commerce market grows, businesses need a payment integration that can serve a growing global customer market that may want to pay by methods not used by U.S. customers. A modern payment gateway should not be bound by borders or payment types; it should be able to seamlessly handle multiple types of payments from all around the world.

Does the payment gateway support non-traditional payment methods?

Credit and debit card transactions are not the only ways that modern customers want to be able to pay. In addition to established alternative payment methods like PayPal, multiple major companies have created digital wallets—Google Pay, Samsung Pay, and Apple Pay, among others—that allow customers to manage their payment information from within an app, making it essential that the payment integration can interact with each of these digital wallets. Furthermore, different countries use their own versions of digital wallets, including the popular WeChat Pay in China. Finally, the newest non-traditional payment method—cryptocurrency like Bitcoin—is exploding in popularity among consumers. Businesses need to consciously decide whether to accept cryptocurrencies; cryptocurrencies come with both disadvantages and advantages for businesses.

Does it support your security and compliance goals?

Modern payment gateways come with all of the security and compliance features that a business needs, including fraud detection and prevention as well as features that ensure adherence to regulatory requirements and accounting standards. While businesses can get many of these same features through other platforms, including Salesforce itself, there’s no reason not to invest in an integration that prioritizes security and compliance. The best payment integration on the market have consciously invested in designing systems that integrate with and complement the security and compliance features offered through the systems like Salesforce that integrate with them.

Investing in the right payment integration is a strategic decision that every business should spend time researching and learning about. When you’re evaluating payment gateways, businesses should be looking into whether the payment gateway is natively built to integrate with Salesforce, whether it’s fully scalable as the business grows and expands into new markets, whether it can support non-traditional payment methods, and whether it can enhance a business’s ability to achieve its security and compliance goals.

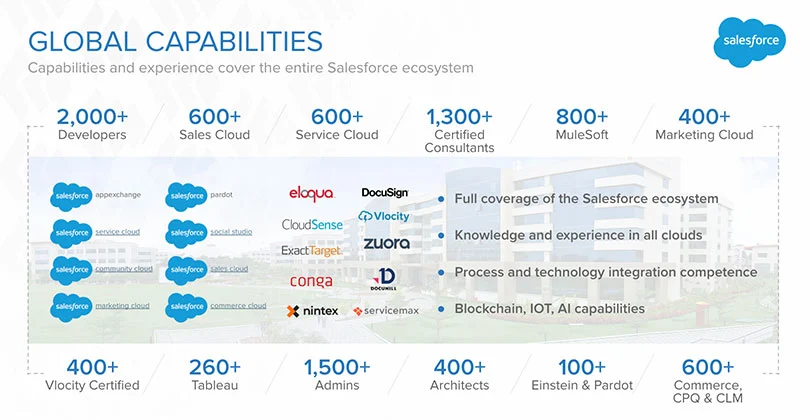

Simplus is well-versed in the advantages and disadvantages of different payment gateways in the marketplace. As a starting place, we recommend considering the following payment gateways, all of which will seamlessly integrate with Salesforce:

—Payflow Pro

—Payeezy

—Authorize.net

—CyberSource

To learn how Simplus helped a data center operator incorporate multiple systems into a fully integrated, dynamic operating environment, please check out this Simplus case study with Netrality.

If you’re looking for expert help choosing and integrating a payment processor into your Salesforce ecosystem, please reach out to the implementation experts at Simplus. We’d be glad to help ensure you get maximum value from your payment processor.

0 Comments