The financial services industry is in an excellent state right now, largely thanks to the improved technological solutions that streamline and regulate so many aspects of the industry. Bankers, accountants, stockbrokers, and more are enjoying a strong job market and increasing access to useful software.

Nonetheless, many in the industry struggle to overcome certain challenges. In order to work effectively, it’s important to be able to focus on what matters, without distractions. That’s where Salesforce comes in. In this series, I’ll be covering some of the core offerings from Salesforce and how each one is uniquely suited to improving financial services processes and success.

First, let’s introduce some basic features of Salesforce and how they help overcome four different difficulties faced by those in the financial services industry: compliance, customer experience, cybersecurity, and integrating AI.

1. Regulatory compliance

As your business grows, it becomes more and more important to ensure that you’re compliant with all necessary standards and regulations. As a point of reference, the American financial services industry spends $270 billion per year on compliance-related costs, and much of that is made up of settlements, enforcement actions, and fines. Keeping your business afloat requires airtight control over your legal compliance.

Luckily, Salesforce makes it easy to remain compliant. For example, Salesforce Shield is a tool that prevents unauthorized users from accessing data. Through a combination of data encryption and event monitoring, you can rest assured that your customers’ data is protected, and whenever data is accessed, the action is recorded—should a record ever be needed. We’ll cover Shield more in-depth later on in this series.

Additionally, Salesforce’s incredible automation does much more than save you time and effort—it also ensures that each of these automated actions is legally compliant. When documentation is needed, you can generate accurate, compliant documents in a matter of minutes.

2. Customer experience

Providing a good customer experience is more important than ever. One study estimates that, by 2016, 89% of companies were primarily competing on the basis of customer experience. It makes sense; after all, who doesn’t want to be treated well while spending money?

Salesforce Financial Services Cloud (with templated solutions for Retail Banking, Insurance, and Wealth Management) can help you keep your customers satisfied and personally cared for. Each of your customers will receive a customized experience in Salesforce: greeted by name and provided access to all of the relationship information they may need. Their long-term financial goals are not only recorded but they’re also actively pursued, with the customer being presented with suggestions in line with their goals. This, in turn, helps reassure the customer that their money is being handled with care.

The fact that these tools can be accessed remotely, from anywhere with a computer or smart device, has really changed the game. Those with active lifestyles appreciate not having to make a trek to the bank whenever they need to access their financial information. If that wasn’t enough, Salesforce’s suite of tools for financial services offers real-time, data-driven updates on customers’ financial situations, so you can always be sure of the status of their investments. All of this combines to create happy customers, and happy customers are repeat customers.

3. Cybersecurity

Digital integration can greatly increase efficiency, convenience, and reliability, but the cybersecurity threat we face in 2019 is as big a threat as the industry has ever seen. The financial services industry is entrusted with the responsibility of safeguarding the personal information of millions of people. A breach in your security can mean thousands of betrayed customers, millions of dollars in costs, and heavy legal ramifications.

Save yourself the hassle and use a system that helps you maintain proper security practices. Salesforce offers excellent resources that can help users, administrators, and developers protect their valuable information. Through detailed manuals, interactive training, a well-maintained digital infrastructure, and the best cybersecurity professionals in the business, Salesforce ensures that your data is in good hands.

Many people are understandably suspicious of cloud-based data. After all, wouldn’t it be safer to keep your data on-site, rather than online, where any hacker can access it? A fair concern, and one that is thankfully misguided. Cloud-based data is proving itself to be the safest form of data storage, in addition to the most convenient. 83% of IT leaders feel safer now with their data on the cloud than they did five years ago, and Salesforce is becoming safer every year. You can rest assured that your security is a top priority.

4. AI integration

You’ve probably read some of the countless reports espousing the use of AI in the financial services industry. After combing through a few, you’ll notice a common consensus: robust AI integration can be an incredibly powerful tool, but the technical and legal challenges that must first be overcome can prove daunting to small and large businesses alike. To fully take advantage of this new technology, you need to ensure that your AI solution is bias-free, legally compliant, and secure.

Say hello to Einstein, Salesforce’s powerful, AI-driven tool to help people across the world make correct financial decisions. Einstein is a suite of tools designed for use in a variety of industries, including sales, service, and marketing. AI-powered recommendations, answers, and explanations are right at your fingertips, as Einstein can be installed onto any device. Salesforce has done the work of developing compliant, trustworthy AI to use alongside their software solutions; all you need to do is take advantage of it.

The financial services industry is in a state of flux, with new challenges and new opportunities appearing in seemingly equal measure. To meet these demands, Salesforce is constantly working to update their services, ensuring that you have the tools you need to stay on top. Whatever your role in the financial services industry, you can be sure that Salesforce is an excellent choice for you and your customers.

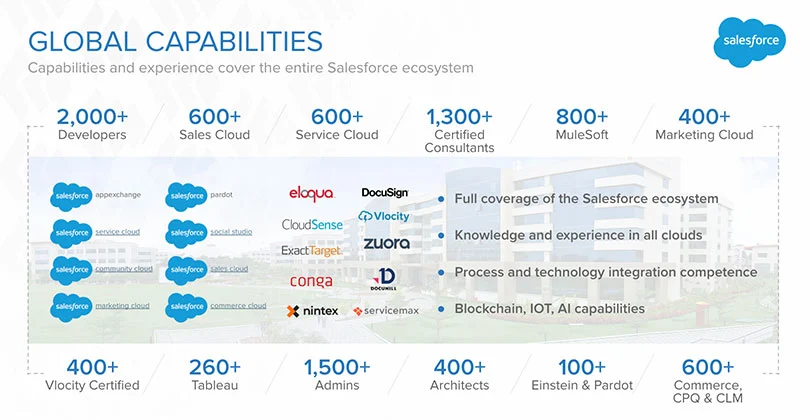

To get started with Salesforce today, reach out to Simplus and our advisory team for expert roadmapping and guidance.

0 Comments