Investing in the customer experience consistently pays off. It’s a point proven over and over in research. One recent study of B2B sales in the SaaS industry found that focusing on customer retention can increase revenue by as much as 80 percent within two years. The customer experience extends to how customers pay their bills, and the industry-leading Salesforce Billing platform plays a foundational role in optimizing this key customer experience.

Salesforce Billing isn’t intended to replace a business’s payment processor, but rather to enhance the payment processor from a customer experience perspective. Salesforce Billing adds modern, customer-friendly features and functionality to payment processors that are either lacking in the payment processor or difficult to reproduce. When businesses integrate their payment processor with Salesforce Billing, customers are more likely to be able to pay the way they want to and are more likely to have seamless, secure payment experiences. Let’s explore four key features of Salesforce Billing every business should use when processing payments:

Payment gateway tokens

When a business integrates its payment processor with Salesforce Billing, the goal is to make payment records accessible to both customers and the business from within Salesforce itself. This transfer of customer data into Salesforce enables Salesforce to serve as the central nervous system for the business; Salesforce can access and retrieve all payment records to answer customer questions and facilitate order fulfillment. Despite this transfer of payment data to Salesforce, the customer’s actual credit card number and/or account number are never transmitted to Salesforce; this payment information remains secure within the payment gateway, which is a third-party system that connects businesses to payment processing networks, such as credit card companies. And the way Salesforce can avoid having to receive the payment details is via payment gateway tokens. Tokens are unique values that represent the customer’s payment information within the payment gateway. As a result, all the payment records that businesses want flow continuously into Salesforce, even as there’s no chance of actual payment details entering Salesforce—and thus no chance of that payment information inadvertently becoming compromised or exposed.

Payment information save option

Modern customers expect to be able to save their payment information on a business’s website to auto-pay their bills and/or to expedite payment for subsequent transactions. It’s quickly becoming a standard feature of modern businesses, and Salesforce Billing enables businesses to give this option to customers. Best of all, because Salesforce uses payment gateway tokens, credit card and bank account information is never directly sent to Salesforce; instead, Salesforce uses a secure, encrypted token to process payments.

PCI compliance

PCI (Payment Card Industry) compliance refers to an information security standard that businesses must consistently meet when they accept, process, store, and transmit credit card information. By default, Salesforce Billing is Level 1 PCI-compliant and has been since 2012. Indeed, Salesforce Billing uses payment gateway tokens, which means Salesforce never comes into direct contact with credit card information. Instead, it’s the business’s third-party payment gateway that serves as the middleman, interacting with the payment processor and then with Salesforce to confirm the payment is successful (or unsuccessful). For businesses that want to build a custom Salesforce component to collect customer payment information, or want to migrate payment information into Salesforce, it’s important to do so in a way that keeps the business PCI-compliant. Often in these scenarios, customers must re-enter their payment information for Salesforce to re-generate a payment gateway token—but that’s the necessary, best-practice way that Salesforce ensures PCI compliance.

Expired credit card management

Customers are rarely diligent about updating their credit card information when it expires. And businesses can pay the price: If a business sends expired credit card information to the payment processor, the business can get hit with rejection fees. Fortunately, Salesforce Billing can be configured to be on the lookout for expired credit cards—and to automatically prevent these cards from being run. Even better, Salesforce Billing can be configured to send reminders to customers when their credit card information is about to expire. Thus, Salesforce Billing proactively helps businesses to keep customer credit cards up to date.

Salesforce Billing comes pre-loaded with multiple important features that help businesses streamline, automate, and enhance payment processes. When you incorporate Salesforce Billing into your routine payment processes, you gain access to features like payment gateway tokens that transmit only the payment data you want, an option to let customers save their payment information and set up auto-pay, PCI compliance to stay within the bounds of information security standards, and management of expired credit cards to reduce the risk of rejection fees.

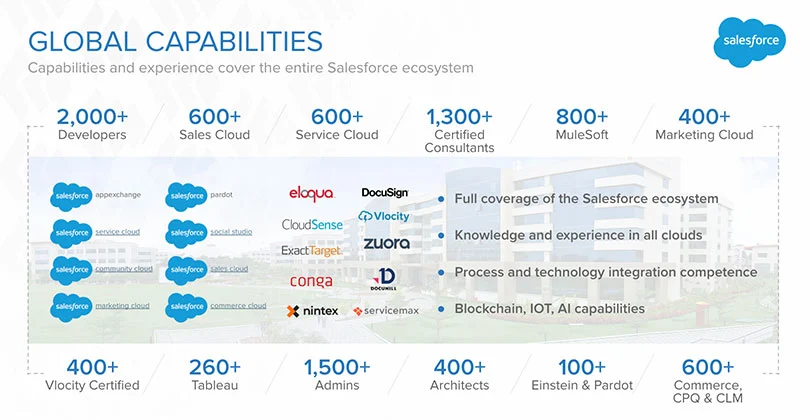

Simplus understands the inner workings of Salesforce Billing and knows how to help businesses utilize and configure important payment workflows. To learn how Simplus helped a financial services company update and enhance its Salesforce operating environment, please check out our case study with NorthMarq.

If you’re looking for guidance and support configuring Salesforce Billing to support payment processing, please reach out to our implementation experts at Simplus. We’d love to help you get the most out of Salesforce Billing’s powerful features and functionality.

0 Comments