Most businesses have an ERP (enterprise resource planning) system, but a sizable proportion of these businesses aren’t getting the value from it that they should. Just 78 percent of businesses report receiving business benefits from their ERP, and 37 percent report receiving less than half of the benefits they expected, according to a Panorama Consulting study. One of the key ways that businesses extract value from their ERP is by integrating it with other systems—notably, their Salesforce instance. Salesforce’s Billing app is optimally suited to provide clean, reliable sales transaction data to ERPs—thereby extending the value of both Salesforce and the ERP.

Before businesses can integrate Salesforce Billing with their ERP, they must first decide when in the lifecycle of their sales transactions to hand off their Salesforce orders to their ERP. Businesses have multiple options for when to make this handoff. They can let Salesforce handle all activities through invoicing (known as “lead-to-invoice”), through payment collection (known as “lead-to-cash”), or through revenue recognition (known as “lead-to-rev rec”). While “lead-to-invoice” tends to be the best-practices, default option during many Salesforce Billing implementations, it’s not necessarily the best option for every business. Let’s explore four key questions every business should answer to help decide when in the sales lifecycle is the best time to make a Salesforce-to-ERP handoff:

Does your ERP support compliance with accounting standards?

Businesses are expected to carry out all revenue-recognition activities in accordance with International Financial Reporting Standards (IFRS), Accounting Standards Codification (ASC) 606 reporting regulations, and Generally Accepted Accounting Principles (GAAP). This can be particularly challenging for older ERP systems—or ERP equivalents—that are not designed to manage complex revenue-recognition activities, especially recurring revenue.

Businesses whose ERP systems don’t support full compliance with all accounting standards should consider letting Salesforce Billing take care of much of the sales transaction lifecycle as possible—in this case, the “lead-to-rev rec” option. Similarly, if the ERP is working well for back-end accounting functions but not for payment collection, then the “lead-to-cash” option could be the perfect middle ground.

Are you devoting excessive resources to fixing billing errors?

Billing errors are unfortunately a common occurrence in many businesses. Often, a quote or an invoice is generated for a sale, but then the business collects a different payment amount. This discrepancy might stem from a pricing adjustment—either a surcharge or a credit—where the business’s ERP simply isn’t designed to readily accommodate the adjustment. In other cases, the discrepancy is linked to recurring revenue transactions, where legacy ERPs aren’t able to properly apply credits and debits to update the balance. In all of these cases, businesses traditionally default to remedying issues as they’re discovered—in other words, to manually correct payment mistakes in a one-off manner. Not only does this stopgap approach result in mistakes slipping through the cracks, but it leads to the business potentially shortchanging itself on the payments it should be collecting.

When businesses find themselves devoting excessive resources to fixing payment errors on a case-by-case basis, the solution is to let Salesforce Billing handle invoicing as well as payment collection—known as the “lead-to-cash” workflow. With “lead-to-cash,” there’s no handoff during the invoicing and payment collection stages between Salesforce and the ERP. Instead, invoicing and payment collection are performed by a single system (Salesforce), which draws both invoice and payment-collection information from a single source of truth.

Do you need a more customer-focused view of A/R (accounts receivable)?

Modern businesses often strive to create modern customer experiences by offering customers maximum flexibility and convenient self-service options. They give customers the option to pay by credit, debit, ACH, or check—and to track payment status via a self-service portal. They let customers set up recurring payments to pay invoices immediately via a self-service portal, and also let customers change their existing subscription bundles. And they automatically add all applicable discounts and deals when auto-renewing contracts and subscriptions.

Across all of these scenarios, businesses are trying to deliver a customer-focused, fully transparent, self-service approach to what is typically a set of internal accounting workflows that the customer cannot readily access on their own. When businesses want to provide this level of accessibility, Salesforce Billing becomes much more than just an invoicing tool. Whether a business chooses “lead-to-cash” or “lead-to-rev rec,” Salesforce Billing is loaded with features to manage even very complex A/R (accounts receivable) activities. The A/R data generated by Salesforce Billing is both of high quality and accessible to customers.

Are your sales and finance teams working together effectively?

Businesses are under constant pressure to streamline and optimize their invoicing, payment collection, and accounting functions. Because all of these tasks are so closely interlinked, sales and finance must work effectively together. Unfortunately, sales and finance teams often work in silos: Sales teams use Salesforce, and finance teams use an ERP/Accounting system. Opportunities to collaborate and exchange information and ideas are few and far between.

Thus, the juncture at which sales transactions in Salesforce get handed off to the ERP can have a major impact on the workflows and overall relationship of both sales and finance. As you’re making the choice between “lead-to-invoice” or “lead-to-cash” or “lead-to-rev rec,” you should be thinking about which option will best promote the types of collaboration and interaction you want to encourage between sales and finance.

Final thoughts

There’s not a one-size-fits-all answer for when in a sales lifecycle businesses should hand off Salesforce orders to their ERP. The decision is ultimately a balancing act that considers how well the business’s ERP supports compliance with accounting standards, how much time the business is spending correcting billing errors, how customer-facing the business wants its A/R data to be, and how to encourage more dialogue and interaction between sales and finance teams.

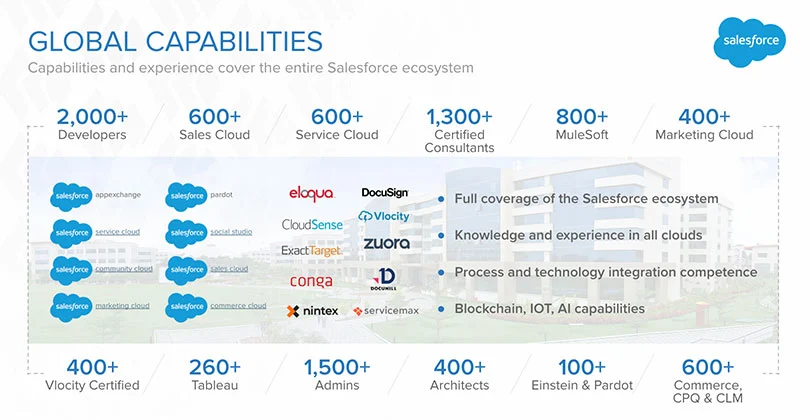

Simplus is well-positioned to help businesses make informed decisions about how to optimally integrate Salesforce with an ERP system. To learn how Simplus helped a biotech company seamlessly merge a legacy system with Salesforce, please check out this Simplus case study.

If you need help choosing “lead-to-invoice” or “lead-to-cash” or “lead-to-ledger” for your Salesforce Billing configuration, please reach out to the implementation experts at Simplus. We’ll be glad to help you choose the option that’s right for you—over both the short and long term.

0 Comments