The purpose of Wealth and Asset Management is being reframed. Investors are looking beyond maximizing financial returns and want their investments to spark and support change. This trend, accelerated by the COVID-19 pandemic and recent social unrest, presents a growth opportunity for wealth and asset management firms that can ideally combine that sense of doing good with sustainable, long-term performance.

Post COVID-19 there continues to be a large movement that has permanently changed the way Wealth Managers deliver advice and serve their clients. To drive outperformance over the next 5+ years, we are seeing firms double down on technology investments, strategically cut costs, build differentiated product offerings and consider inorganic opportunities.

In a report from Morgan Stanley on Global Wealth Management it outlined how COVID-19 has fundamentally changed the Wealth Management industry, evolving client demands and diminishing outlooks for top line growth. Wealth Managers are rising to the challenge to meet those customer expectations, with integrated Wealth Managers proving to be a stable anchor to group valuations. Simply put, they can continue to earn a high multiple relative to other Financial Services sectors if management teams have the right strategy.

What are the Priorities?

Adapt to the new normal

With digital engagement increasing 7-10x across leading Wealth Managers following the onset of the pandemic, COVID-19 has altered clients’ expectations for financial advisor (FA) and relationship manager (RM) interaction, while also underscoring the value of human advice. Wealth Managers must move quickly to design an omni-channel advice delivery model and accelerate their digitization efforts. The advice delivery model of the future will see RMs remaining central to client relationships, supported with strong digital capabilities.

Defend business economics

Costs will be in the spotlight as bottom lines are pressured by diminished growth and challenged revenue margins. Wealth Managers must improve their approaches to cost management to deliver positive operating leverage. We estimate that efficiency plays can reduce average industry cost income ratios (CIR) by up to 12 percentage points through focus on a couple of key areas:

- Streamlined group service delivery (short to medium term) – Streamlined group service delivery, especially from second line functions, Finance, Human Resources (HR), Legal and Operations.

- Transforming the operating model (medium term) – Transformations to operating models and associated IT infrastructure driving both cost savings and incremental revenues. Although these transformations have the potential to deliver significant CIR improvement, they are a complex undertaking for any player and can introduce significant risk.

Consolidate share and drive growth

Wealth Managers who can act from a position of strength should move to consolidate share and increase growth by enhancing their product offerings and footprints through organic and inorganic means. This means Wealth Managers must develop differentiated propositions to protect and grow their revenue base.

One use case that we continue to see trend upward is sustainability. According to Morgan Stanley high-net-worth (HNW) and ultra-high-net-worth (UHNW) sustainable investments are expected to grow by 18 percent each year to a total of $9 trillion by 2024. Consequently, Wealth Managers that can credibly build and offer sustainable investment offerings stand to benefit by gaining a highly attractive and often younger client segment.

Wealth Managers need to develop a framework to effectively prioritize their digital investments

We know that post COVID-19 that there is a demand for significantly increased client digital engagement along the value chain. This increased digital engagement is a win-win for both clients and Wealth Managers, as it provides rich data to understand which use cases clients truly value.

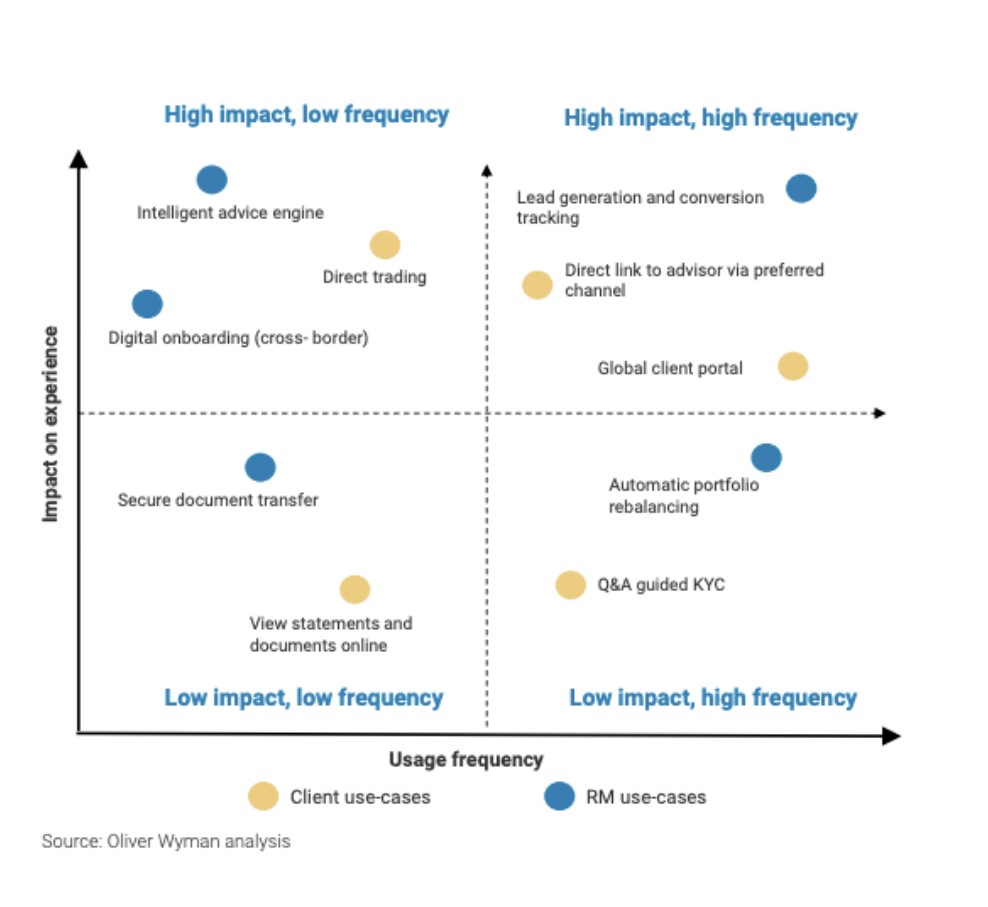

Given the ever evolving landscape and client expectations, Wealth Managers should take a step back to assess their as-is and future state digital portfolio. Achieving best-in-class digital experiences at each step of the value chain remains unfeasible for any Wealth Manager given capital and resource constraints. To overcome this challenge Wealth Managers need to prioritize the use cases that are most valued and impactful for their end clients or RMs, so they can deliver the biggest bang for the buck.

Take a look at the graphic below. Analysis across a variety of use cases shows which use cases have the most impact on both client and RM experience. The use cases that can deliver transformational impact are those that significantly improve the client experience and with which they interact frequently.

Of course, Wealth Managers also need to evaluate use cases against the cost and complexity to implement. The more innovative Wealth Managers frequently use partnerships to minimize development costs and accelerate implementation timelines.

Simplus engages with our clients to help them navigate this complex space. We see a number of investments across a variety of technology and applications that make it cumbersome for Advisors and Relationship Managers to really differentiate with their clients. The landscape is still riddled with legacy processes and multiple applications. Reach out today to connect with our team of financial services strategy experts to take the next step in your transformation journey.

Not ready to connect? Check out how this Canadian bank transformed its digital technology with Salesforce to make its advisors’ jobs easier — and more productive.

0 Comments