One of the most consequential decisions any business makes is how it’s going to manage routine sales transactions—specifically, invoicing, payment collection, and accounting. A whopping 29 percent of all startups fail as a result of running out of cash, according to a 2019 study by CB Insights. Salesforce Billing plays a key role in helping businesses stay in the black, managing multiple aspects of the sales transaction lifestyle. But Salesforce is not the only system that organizations need to manage sales transactions: At some point in a transaction lifecycle, businesses typically hand off their Salesforce orders to a behind-the-scenes ERP (enterprise resource planning) system.

Businesses that use Salesforce Billing have multiple options for deciding when to make the transition from Salesforce to ERP. Essentially, Salesforce Billing can take over as many of the traditionally ERP-driven functions as the business prefers; the decision is specific to every business and depends on the business’s needs and goals. Let’s explore the three most common junctures where businesses make the handoff from Salesforce Billing to their ERP system: Lead-to-Invoice, Lead-to-Cash, or Lead-to-Rev Rec. Understanding the differences between all three options will ensure you can make an informed, optimal decision for your business.

Lead-to-Invoice

Overview: The earliest major juncture where businesses hand off their Salesforce orders to their ERP system is after the invoicing stage. Thus, Salesforce Billing takes care of “lead to invoice”—that is, Salesforce manages all activities through invoicing. Then, Salesforce hands off remaining activities to the ERP, including revenue collection, accounts receivable, and financial reporting.

Which businesses it’s suited for: Lead-to-Invoice is an ideal configuration when implementing Salesforce CPQ with Billing. In fact, it’s generally regarded as the most effective way to build a quote-to-cash solution like CPQ from the ground up.

More information: Lead-to-Cash uses quote and order data from CPQ to generate an invoice in Salesforce. This invoicing process includes using Salesforce’s native tax engine—in collaboration with third-party integrations—to calculate and apply taxes to the invoice. Because the Salesforce quoting and order data is synced with the business’s own Salesforce product catalog, the process of generating invoices is streamlined and seamless—and significantly, businesses can depend on every invoice to be consistently accurate. The invoicing-related data that gets handed off to an ERP system also is consistently clean, positioning the ERP to dependably manage all downstream revenue-collection and accounting activities.

Lead-to-Cash

Overview: For businesses that don’t want Salesforce Billing to stop at invoicing, the next juncture where businesses can transition their sales transactions from Salesforce to an ERP is after the revenue-collection stage. Thus, Salesforce Billing takes care of “lead to cash”—that is, all activities through payment collection, including invoicing. Then, Salesforce hands off to an ERP, which manages the back-end general ledger and financial reporting.

Which businesses it’s suited for: Lead-to-Cash is an ideal configuration for businesses that are looking for a more customer-focused view of accounts-receivable (A/R) activities. These businesses might currently have lightweight A/R and collections processes.

More information: Like Lead-to-Invoice, the Lead-to-Cash uses quote and order data from CPQ to generate an invoice in Salesforce. But instead of immediately handing off to ERP to manage revenue-collection activities, Salesforce Billing takes care of all collection, including making payment adjustments where necessary. Multiple options are available in Salesforce to manage revenue collection, including a Dunning & Collections extension and a Payment Gateway that can collect payment via credit card and ACH transfers. At the end of the Lead-to-Cash workflow, a clean set of Billing data is handed off to the ERP for general-ledger activities, including revenue recognition.

Lead-to-Rev Rec

Overview: For businesses that want to use Salesforce Billing to the maximum extent possible, the best place to make the handoff from Salesforce to ERP is at the very end of the sales lifecycle. Thus, Salesforce Billing handles “Lead to Rev Rec”—all the way through revenue recognition

Which businesses it’s suited for: Lead-to-Rev Rec is an ideal configuration for businesses that want to minimize their ERP/Accounting role as much as possible. Businesses that are struggling to get their ERP to meet their rev rec needs or are relying on spreadsheets to calculate recognized revenue are particularly good candidates for Lead-to-Rev Rec. These businesses may be facing challenges with insufficient or disorganized data across multiple systems—challenges that require manual intervention to rectify on a one-off basis. For example, some legacy ERP/Accounting systems are simply not built to manage recurring revenue schedules in accordance with modern-day accounting standards.

More information: Salesforce Billing is particularly useful for managing complex revenue-recognition processes, as it’s able to create revenue schedules based on the service period of the performance obligation—even custom date ranges. Salesforce can also assign revenue-recognition policies and general-ledger accounts to a sale based on the legal entity responsible.

Final thoughts

The decision about how to integrate Salesforce with your ERP system is an important one that’s unique to every business. While businesses by default tend to choose to use Salesforce to manage lead-to-invoice functions, Salesforce Billing can alternately be used to manage all lead-to-cash functions or lead-to-rev rec functions. Thus, every business must choose the option that aligns with their unique situation and long-term goals and priorities.

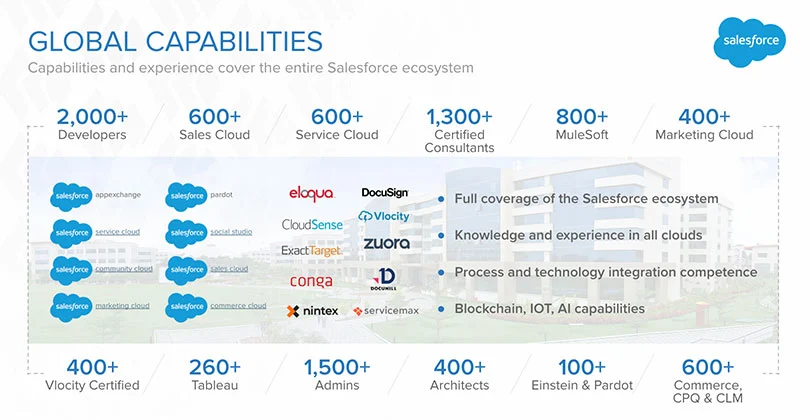

Simplus is a seasoned pro when it comes to making strategic decisions about integrating Salesforce with ERP and other systems. To learn how Simplus helped a financial services company create seamless bidirectional sync for Salesforce, please check out this Simplus case study on the MidAmerica corporation.

If you’re looking for expert guidance navigating how to integrate Salesforce Billing with your ERP, please reach out to the implementation experts at Simplus. We’ll help you figure out when in your sales lifecycle is the optimal juncture to hand off your Salesforce orders to your ERP.

0 Comments