I have a confession to make.

There were many factors that determined the bank I use for my family’s financial services. No fees. High interest. Easy online access. Digital bill paying. You know — responsible, grown-up reasons. But what it really came down to was the candy dish sitting by the bank teller’s computer. When I mentioned that I loved the vanilla Tootsie Rolls, he dug out the bag from under the counter and handed me a pile of vanilla candy. To this day, when I visit the drive-thru window, this same bank teller drops some extra vanilla Tootsie Rolls in with my bank receipt. I’m hooked!

Today, financial services must navigate an ever-changing global customer base with innovative services while facing unprecedented opportunities and challenges. Although we function in a digital world, the need for real connections with customers is more important than ever. By using the Salesforce Financial Services Cloud for Retail Banking, banks are able to leverage state-of the-art cloud technology to maintain — even enhance — the “down-home, cozy feel” that customers love about their bank.

Amid the flashy bells and whistles of computerized banking, experts maintain that the desires of banking customers still rest on trust, great banking options, and respect. If you are in the market of appealing to the new banking customer (i.e. millennials) looking to invest, here are four things today’s customers are looking for in their banking and financial services.

1. Personalized experience.

People work hard for their money. And they want a bank that respects those efforts. “We have always wanted to be appreciated and valued. But the connected generation expects it in several new ways,” says bank consultant Graham Seel. For example, customers want banks to know their name, listen to their wants or concerns, and be taken seriously. Salesforce Financial Services Cloud means every customer will be greeted by name as the rich customer profile of household relationships is accessible at the touch of a button.

People work hard for their money. And they want a bank that respects those efforts. “We have always wanted to be appreciated and valued. But the connected generation expects it in several new ways,” says bank consultant Graham Seel. For example, customers want banks to know their name, listen to their wants or concerns, and be taken seriously. Salesforce Financial Services Cloud means every customer will be greeted by name as the rich customer profile of household relationships is accessible at the touch of a button.

Related: Simplus acquires Basati to enhance Financial Services offerings

2. Proactive options based on life goals.

“The customer experience is a critically important driver of emotional connection,” say researchers Alan Zorfas and Daniel Leemon. Customers are trusting you to respect their money — their financial security — by making sure their bank is avoiding risk and ensuring a customer’s capital is earning optimal returns. Having easy access to a customer’s profile, long-term financial goals, and current investments is an important component of extraordinary customer service. And the Financial Services Cloud is equipped to do just that.

3. Lifestyle fit.

For today’s customers, convenience means more than providing a drive-thru that threads directly into the drive-thru line at the Starbucks next door. (Did I mention my bank does that?) It’s not just about location. Instead, it’s about a bank providing online services that are just as reliable, accurate, and convenient to use in a customer’s backyard as on the banks of Bangkok, the beach, or while stuck in traffic. “Banks are no longer just competing against one another. They’re being compared to any company providing a convenient user experience that builds loyalty,” said Rohit Mahna, SVP and GM of Financial Services, Salesforce. With Financial Services Cloud for Retail Banking, Salesforce is making it possible for customers to love their banks again.

4. Anticipation of the financial climate.

Let’s face it. The relationship between customers and their bank is built on trust. Good, old-

fashioned trust. And customers want assurance that their bank is looking out for their financial back. With a cloud-based wealth management system, advisors can anticipate changes that are

certain to affect a customer’s financial goals and be prepared with pivotal solutions. Partnered with some of the nation’s leading financial services and investment experts, Salesforce provides innovative, real-time data to safeguard the financial future of your valued customers.

Sure, candy is cool. But, when it comes to providing quality, innovative services that enhance your customer’s banking experience, Salesforce Financial Services Cloud for Retail Banking is certain to offer great results.

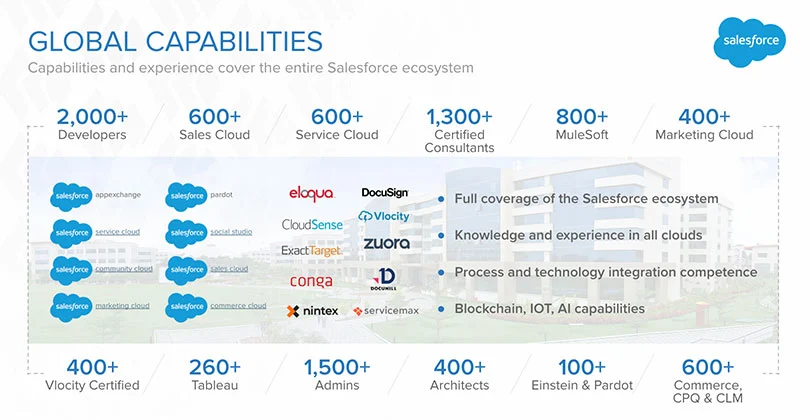

Simplus provides experienced know-how to companies in Financial Services. See for yourself.

0 Comments