Billing is so important to get right, and yet so many organizations get it wrong—repeatedly. The reality is that billing is incredibly complex and nuanced. As much as 80 percent of all bills generated in the healthcare industry, for example, contain errors, according to industry research by the American Academy of Professional Coders. Calculating taxes, of course, adds another layer of complexity to billing. And unfortunately, taxes can be incredibly tough to consistently get right, especially when a business produces multiple versions of sales quotes for customers before closing the sale.

Between the initial quote and final invoice, it’s incredibly common for the calculated tax to change. Perhaps the shipping address changes (on either or both ends), or perhaps the tax rules governing the specific items are modified. On top of these variables, some businesses issue recurring bills—for subscriptions, contracts, and on-demand services—that increase the odds that calculated tax will change over time, even if the exact same product or service stays exactly the same.

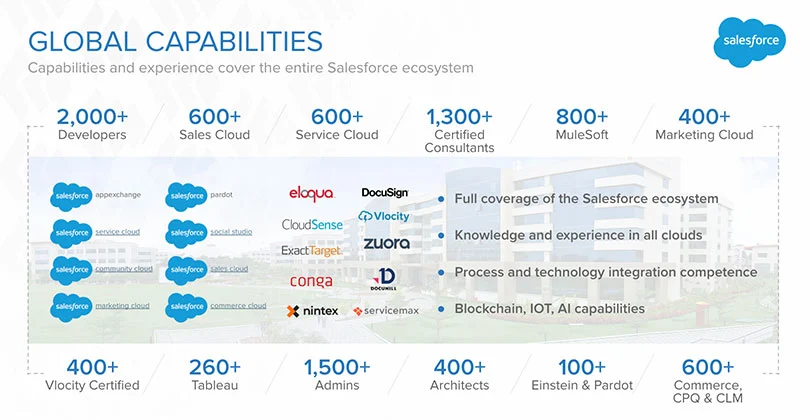

No matter how much focus businesses put on calculating taxes accurately, there are so many variables at play that it’s unrealistic to catch every nuance for every customer 100 percent of the time. Thus, one of the most important ways that businesses reduce the risk of making tax-calculation mistakes is by integrating their tax calculation system with Salesforce, especially the Salesforce CPQ and Billing platform. Such a connector automates the entire billing process, ensuring final invoices and bills are generated accurately and in full compliance with tax rules. And best of all, this integration is readily achievable for businesses of all sizes, as Salesforce Billing is already pre-built to integrate with the two biggest tax calculation systems, Avalara and Vertex. Let’s explore four key advantages to integrating your tax calculation system with Salesforce Billing:

You’ll be able to readily update quotes as conditions change

A lot can happen between the time that tax is calculated for a sales quote vs. for the final invoice. Customers might tweak the items and item quantities in their order, the shipping information could change, even the entity making the purchase may change. Similarly, on your end, new promotions and volume-dependent discounts might alter the total amount of the quote, or your business might even physically relocate to a new tax jurisdiction. Whenever these variables change, it’s important that you’re able to generate quotes—and eventually, an invoice—that consistently reflects the correct taxes. Not only do your customers expect that taxes are always going to be reported accurately, but some of these variables have the potential to dramatically impact the amount of taxes a customer must pay—tax differences that can make or break a sale. When Salesforce is integrated with your tax calculation system, you’re able to readily and automatically update quotes. Moreover, you have confidence that all versions of quotes—and subsequently, the final invoice—are accurate. By contrast, when your Salesforce CPQ and Billing system isn’t integrated with your tax calculation system, your sales team must manually update tax information in Salesforce every time your tax calculation system recalculates taxes. This manual data entry process is time-consuming and error-prone.

You’ll be able to accommodate recurring bills

Many businesses offer products and services that require a recurring bill. These products or services frequently change price. And even when prices don’t change, the calculated taxes might nonetheless still change. For example, perhaps there’s a change in the tax rules affecting the recurring bill, or perhaps there’s a change in the shipping address on your end or the customer’s end that changes how taxes get calculated. Traditionally, when these situations have arisen, businesses struggle to update tax calculations consistently and universally. By integrating Salesforce Billing with your tax calculation system, however, you’re able to eliminate much of this haphazardness and unevenness—as these adjustments happen automatically and in real-time. The end result is changes in tax calculations are applied uniformly to all recurring bills—at precisely the time these changes should be taking effect.

You’ll be better positioned to comply with tax rules

One of the most common mistakes that businesses make when calculating taxes is basing their calculations entirely on the tax rules in the ship-to location. Unfortunately, that’s not always an accurate approach to take: Some tax jurisdictions require considering the rules in both the ship-from and ship-to location. Another common tax-calculation mistake that businesses make is erroneously assuming the ZIP code + 4 digits is precise enough for determining which tax rules to apply. In reality, there’s not always a one-for-one alignment between ZIP code + 4 digits and tax jurisdictions; indeed, there are more than 10,000 tax jurisdictions in the U.S. alone. Businesses can avoid these tax-calculation pitfalls by integrating Salesforce Billing with their tax calculation system. After your tax calculation system parses out these nuances in tax rules, the correct tax calculations populate automatically to customer invoices in Salesforce Billing.

You’ll be able to consistently minimize taxes for your customers

The best tax calculation systems make it easy for businesses to determine an optimal combination of ship-from and ship-to addresses to minimize taxes owed. Especially when there are multiple potential shipping options on both the origin and destination ends—and they’re all comparably convenient for both the customer and the seller—there’s no reason not to take advantage of opportunities to lower the customer’s taxes. It’s a win-win situation for you and your customer. And this benefit becomes simple and intuitive to operationalize for every customer; all you need to do is integrate Salesforce Billing with your tax calculation system.

Being able to consistently calculate taxes accurately is an integral part of fostering a seamless customer buying experience. Integrating Salesforce Billing helps advance your customer experience goals by making it easy for you to update quotes as conditions change, accommodating recurring bills, ensuring you’re in compliance with all tax rules, and minimizing the amount of taxes your customers must pay.

Simplus is an expert at integrating Salesforce Billing with your tax calculation system to deliver superior business outcomes. To learn how Simplus helped an engineering software company use Salesforce to optimize its billing processes under a dynamic pricing structure, please check out this Simplus case study with EasyPower.

To learn more about how integrating your tax calculation system with Salesforce Billing, please reach out to the implementation experts at Simplus. We can’t wait to show you how to unlock the value of this integration.

0 Comments