The vast majority of businesses use Customer Relationship Management (CRM) software—and for good reason: CRM applications can increase revenue by up to 29 percent, according to 2019 industry research. One of the main ways that CRM systems like Salesforce can drive sales growth is because they integrate with other systems. In particular, Salesforce is designed to readily integrate with a wide variety of other platforms and systems—and that includes payment processors.

A business’s payment processor plays a key role in defining what the customer experience will be like. The right payment processor can drive customer affinity and loyalty. Unfortunately, many payment processors aren’t optimally designed to provide exceptional customer experiences—at least not on their own. That’s where Salesforce Billing comes in. By integrating with the business’s payment processor, Salesforce Billing extends the utility and value of the payment processor. Let’s explore four key reasons why every business should integrate their payment processor with Salesforce Billing:

Maximize revenue collection

Every business deals with customers whose payment information has expired, or who provide incorrect payment information, or who don’t pay their bill on time (or at all). All of these scenarios lower the revenue a business collects, either because the business never succeeds in collecting this revenue, or because the business must invest extra resources to collect it. Salesforce Billing is designed from the ground up to streamline and automate revenue collection processes. When customer service teams and other business lines gather payment information, they can easily update that information in Salesforce, as well as instantly process a payment—in real-time—at the click of a button. Similarly, Salesforce can be easily configured to automatically retry credit cards that get declined and to automatically notify customers of key events, such as payment due dates and when their credit card information on file is about to expire.

Reduce payment errors

Payment processors and associated ERP (enterprise resource planning) systems often struggle to manage complex billing processes, including recurring and subscription payments, credits, and discounts. Not only do businesses commonly experience revenue losses from these errors, but these errors also interfere with businesses’ ability to comply with revenue-recognition processes and general accounting standards. By contrast, Salesforce Billing is expressly designed to streamline and automate these billing processes and, moreover, to complete revenue recognition activities in accordance with accounting standards.

Improve oversight of payment transactions

Every business needs to keep a watchful eye on its payment processor during sales transactions—there are simply too many things that can potentially go awry. Unfortunately, many payment processors aren’t designed to make it easy and intuitive for businesses to oversee payment processing and to flag potential problems. Not so with Salesforce Billing. When a business integrates its payment processor with Salesforce Billing, Salesforce automatically generates payment logs and prepares audit reports that can be traced back to individual customers and individual employees who intervened on a customer’s behalf. Furthermore, the automatic email notification features that Salesforce is famous for can be configured in Salesforce Billing to notify specific departments when payments are late, when customers pay less than what’s owed, or when payments are unable to be processed on time.

Expand access to payment records

Payment processors are traditionally designed for finance teams to access and manage. That means customer service teams, sales teams, and ordering and fulfillment teams often don’t have an easy, direct way to access payment records to facilitate order processing and answer customers’ questions about billing and payments. However, when businesses integrate their payment processor with Salesforce Billing, the payment and billing data all flow automatically into Salesforce Billing, creating a centralized repository for financial records that other teams across the organization can access and retrieve data from. Through Salesforce, teams can access full payment history, including exactly when customers paid what, as well as any refunds, credits, and declined payments. This expanded access helps ensure that transactions are completed correctly and in a timely manner and that all relevant teams can access and update financial records in real-time.

Salesforce Billing is an optimal solution for extending the utility and value of your payment processor. When you integrate your payment processor with Salesforce Billing, you’re able to supercharge revenue collection activities, reduce payment errors that take time and resources to remedy, improve oversight of all payment transactions, and expand access for teams across your organization to customer payment records.

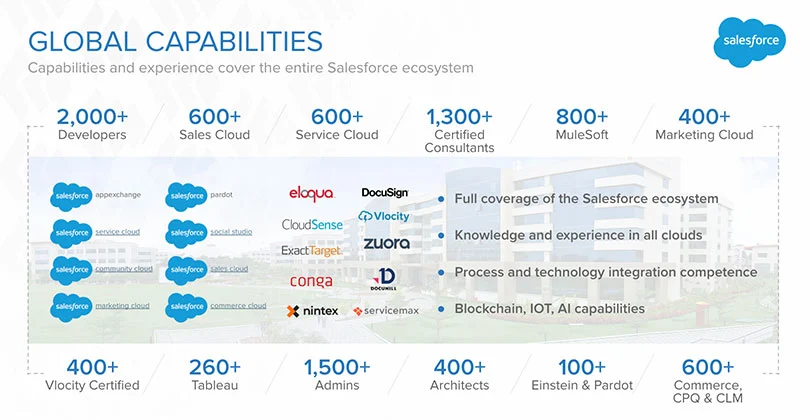

Simplus specializes in integrating payment processors with Salesforce Billing. To learn how Simplus helped a financial services company create a seamless bidirectional sync for Salesforce, please check out this Simplus case study on the MidAmerica corporation.

If you’re ready to integrate your payment processor with Salesforce Billing, please reach out to the implementation experts at Simplus. We’ll be glad to help you with this integration—and upgrade to a different payment processor if you need it.

0 Comments