Insurance is always on every consumer’s mind, but often not happily: it’s the necessary evil and the nightmarish web of policy intricacies no one seems to understand. Those stereotypes are, however, slowly changing; more consumers are calling out the decades of institutionalized focus on profit before clients, and more insurance providers are altering their business models to generate that profit while actually investing time and care into their consumers’ well-being. It’s a fascinating time to watch the industry evolve and adapt.

Early on in 2023, we identified three innovations the insurance industry needs to keep top of mind to survive and thrive in the coming year. Now at halftime, we’re checking in on these trends: more options for improving customer experience (CX), higher levels of operational efficiency, and low-code/no-code solutions for business.

More options for elevated CX

As we listed at the beginning of the year, the outlets for advanced and seamless CX are ever-expanding for the insurance market, from automated claims processing and predictive analytics to wearable IoT technologies, digital platforms, and mobile apps. Whichever combination of these avenues makes the most sense for your organization, the purpose and intent remain the same: make customer interactions easier, sleeker, and happier. The shift to more digitally savvy and improved CX in the insurance industry took off after the pandemic, and now post-pandemic no one seems to be turning back. We’ve seen more and more insurance clients request the technologies and roadmaps that prioritize CX above all, because they know their policies and services are changing to make them more truly customer-centric than ever before.

Higher levels of operational efficiency

There are numerous ways we’ve been watching insurance clients transform their operations to be more efficient this year: digital distribution, cloud platforms, automation, machine learning, AI, and any other means of eliminating any cumbersome, error-prone, paper-dependent processes. What we’ve also noticed is a quickness to get excited about and jump on AI—which is great, until it isn’t. While AI is certainly the next frontier, many organizations want to implement it faster and more extensively than their tech stack maturity is prepared for. It’s critical to start where you are and build toward AI functionality. One perfect example of this is with the insurance call center—the AI outlets are numerous and exciting. But establishing a foundation of self-service options, SSOT data for agents, live chat, etc. will still be necessary before diving into more advanced AI and machine learning options.

Low code and no-code solutions for building business

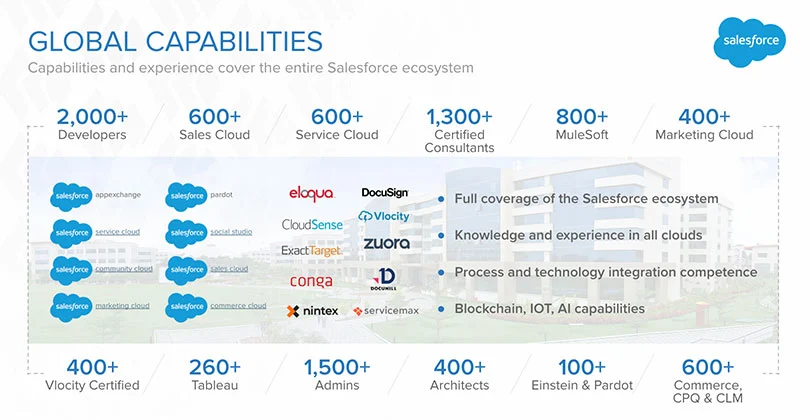

Finally, we continue to see more decision-makers in insurance push their organizations towards more low-code or no-code solutions to scale business further and faster. These solutions can ease the burden on your IT developers, allowing them to be more innovative on other initiatives, and empowering other business teams to develop their own apps, integrations, and other functionalities they may require. At Simplus, we recommend Salesforce as the ultimate platform for minimizing code and empowering your employees to innovate more actively. From intelligent task prioritization and rich customer profiles including life event alerts to database access on any device any channel any time, Salesforce is the key to accelerating your growth and worrying about as little code as possible.

Simplus can be your guide from start to ongoing maintenance (because it’s never truly finished, is it?) of your next big transformative project with Salesforce clouds, from call center digitization to digital process automation for claims and underwriting, or anything else you have on your radar. Reach out today, and let’s talk about where you are now and where you’d like to be.

0 Comments