Insurance organizations are always changing, trying to stay ahead of their policyholders’ needs and, perhaps more critically, distinguish themselves from the plethora of other insurance options they know their customers have. But in the last year alone, over 26 percent of insurance holders switched providers. Some of the biggest reasons customers cited for jumping ship and looking elsewhere? Their previous insurance providers didn’t have user-friendly app experiences to monitor claims, provided a particularly poor service experience in times of need, or had a confusing process for retrieving real-time updated information on policy coverage. To be sure, insurance providers have a lot of stakeholders to answer to and changes are inevitable, but creating a seamless, transparent experience for customers throughout these changes can’t be neglected. Otherwise, you run the risk of losing all customers to begin with.

To mediate these challenges, insurance companies need to adopt the tools and operations that customers are expecting—in other words, they need to go digital and be agile or be left behind. CIOs in the insurance industry can become true leaders of these digital innovation efforts by following our three industry-specific strategies as a starting point:

Align IT initiatives/spending with cost optimization results

CIOs at insurance organizations have to make sure that all their IT spending proposals have a clear link to streamlining operations or improving customer experience—in other words, they have to prove they’ll either shrink expenses or boost revenue. There are many exciting paths and tools available for digital transformation in any industry, and financial services like insurance are among the most prime sectors for serious change. But you won’t get far if your strategies don’t associate themselves with encouraging numbers for the bottom line.

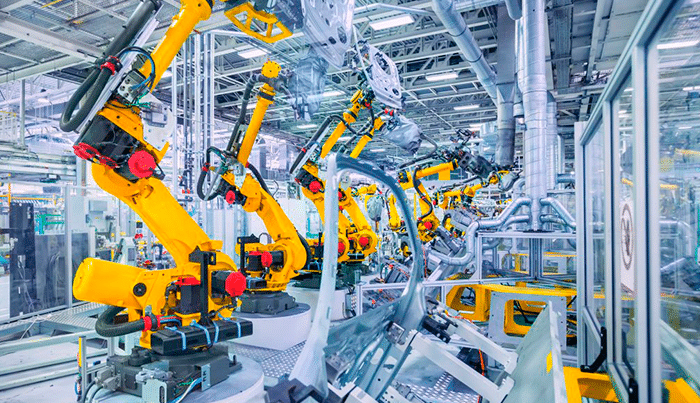

One of the easiest IT sells in the industry is automation technologies. CIOs who champion these platforms are often received warmly by fellow executives and end users alike because advanced automation in the insurance industry means less need for middle man phases (like brokerage and underwriting) and enriching client data for scale. Tedious tasks that cost you more resources and money can be minimized if not removed altogether and your client data can be more dynamic and relevant, creating more engaging experiences for customers and long-lasting loyalty—that’s at least two strong cost optimization cases to bring to the table.

Partner with the COO on an industry-specific Salesforce automation program

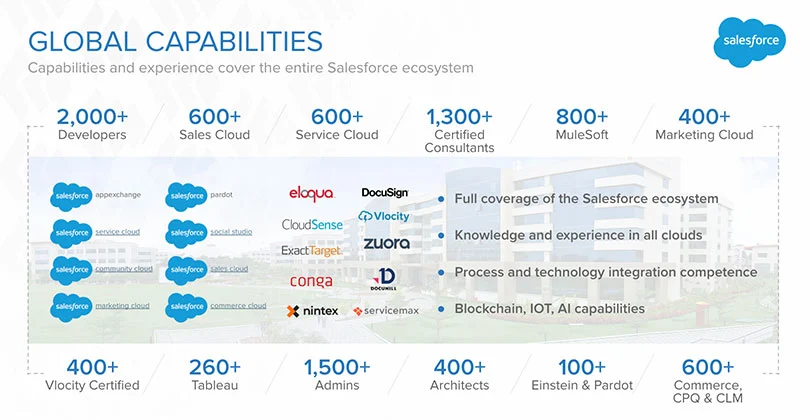

With automation technology as your easiest IT sell, it’s critical you partner early on with your COO on a specific technology roadmap. At Simplus, we strongly suggest Salesforce for its industry-tailored solutions and potential for continuous growth. The insurance CRM portfolio from Salesforce includes workflows specifically enabled for life, property, casualty, and group member insurance offerings.

By selecting Salesforce as the foundation of your overall automation strategy, you’ll be setting your insurance organization up for long-lasting success and a plethora of additional clouds to expand into when the market timing comes. The combined use of multiple relevant Salesforce clouds increases your collective transparency into critical customer touchpoints all along the lifecycle—from initial policy sale to renewal. With more understanding of these touchpoints, you can improve processes strategically to increase not only customer satisfaction but also retention. The Salesforce insurance solution includes Salesforce’s Tableau CRM for data-driven, anywhere decision making, Experience Cloud for building out powerful customer journeys, Commerce Cloud for reaching customers at scale, and Financial Services Cloud for unifying your various lines of business with industry-standard regulations in mind. You can check out this demo to get an idea of how an industry-specific CRM can make all the difference when partnering with your COO for truly beneficial results.

Consider advanced tech like AI and machine learning to improve data

Finally, another top way for insurance CIOs to lead the digital innovation charge is by championing the business case for technologies like AI and machine learning in the industry. These technologies have been transforming operations for many industries, and financial services, in particular, are only beginning to scratch the surface of what can be done.

Insurance organizations have started to use AI and machine learning to verify protected assets with photo recognition, automate signs of fraud or identity theft, and predict future claims of policyholders for more accurate planning. All of these and many more use cases elevate the accuracy and relevancy of insurance data, making it more valuable as a tool to speed up operations, cut down costs, and boost policyholder loyalty.

Ready to take your insurance organization’s strategy to the next digital frontier? Reach out to Simplus for guidance on everything from roadmapping and implementation to strategic managed services.

0 Comments