As we check in with each industry halfway through 2024, it’s clear that the financial services industry is undergoing a seismic shift, driven by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. From the rise of open banking to the greater adoption of Customer Data Platforms (CDPs) for personalized client experiences and the reemergence of call center digitization as a competitive advantage, let’s review how the trends for financial services in 2024 are doing:

Open banking is dominating future innovation roadmaps

At the forefront of financial services innovation in 2024 is the phenomenon of open banking, which is disrupting traditional business models and reshaping the industry landscape. Open banking, characterized by the secure sharing of financial data between banks and third-party providers via Application Programming Interfaces (APIs), has emerged as a catalyst for innovation, collaboration, and customer-centricity.

One of the key drivers behind the widespread adoption of open banking is its ability to empower consumers with greater control over their financial data and access to a wider range of products and services. By enabling seamless integration between different financial institutions and third-party fintech apps, open banking allows customers to aggregate their accounts, track their spending, and manage their finances more effectively, ultimately leading to improved financial literacy and decision-making.

Moreover, we’ve seen firsthand how open banking is fostering a culture of innovation and entrepreneurship with our clients within financial services. Banks and fintech startups are collaborating to develop innovative solutions that address emerging customer needs and pain points. From personalized financial advice and automated savings tools to on-demand lending platforms and frictionless payment experiences, open banking is driving a wave of creativity and experimentation that promises to redefine the future of finance.

Clients expect personalization, so industry leaders are racing to better CDP functionality

In the quest to deliver superior client experiences, financial services firms are increasingly turning to Customer Data Platforms (CDPs) to harness the power of data and insights. CDPs serve as centralized hubs that aggregate, analyze, and activate customer data from multiple sources, enabling organizations to create highly personalized interactions across various touchpoints.

The greater adoption of CDPs in 2024 reflects a strategic shift towards customer-centricity, as financial institutions seek to differentiate themselves in a crowded market by delivering tailored products, services, and communications that resonate with individual preferences and behaviors. By leveraging advanced analytics and AI-driven algorithms, CDPs enable organizations to segment their customer base, predict future needs, and orchestrate targeted marketing campaigns that drive engagement and loyalty.

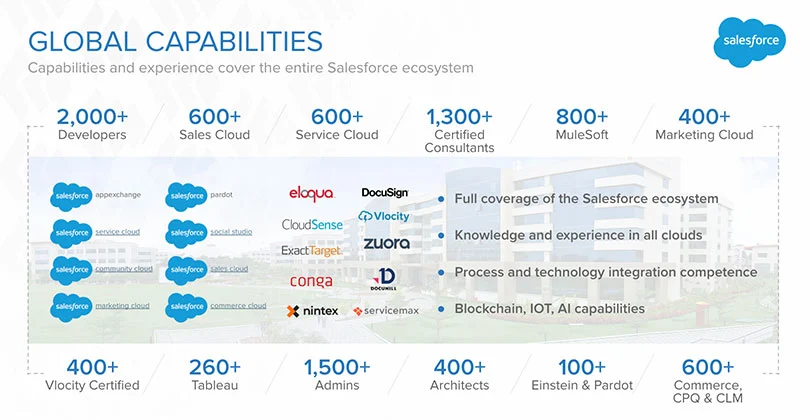

CDPs also empower financial services firms to deliver seamless omnichannel experiences that transcend traditional boundaries and silos, allowing customers to interact with their bank or investment firm anytime, anywhere, and on any device. Whether it’s personalized recommendations on a mobile app, proactive alerts via email, or real-time support through chatbots, CDPs enable organizations to deliver consistent, relevant, and timely experiences that foster trust and loyalty. And there’s no better technology vendor for CDP within a larger IT landscape than Salesforce’s Data Cloud—not merely a CDP, but a data management platform for seamless integration throughout your organization.

Call center digitization is the dark horse for getting ahead of the competition

While much attention has been focused on digital channels and self-service solutions, call center digitization is quietly emerging as a strategic differentiator for financial services firms looking to get ahead of the competition. By leveraging advanced technologies such as AI, machine learning, and natural language processing, organizations can transform their call centers into proactive, data-driven engines of customer engagement and satisfaction.

One of the key benefits of call center digitization is its ability to enhance operational efficiency and effectiveness, enabling organizations to handle a higher volume of inquiries, resolve issues faster, and deliver superior service experiences. By automating routine tasks, such as call routing and basic inquiries, and empowering agents with real-time insights and contextual information, call center digitization enables organizations to deliver personalized, empathetic interactions that drive loyalty and advocacy.

Moreover, call center digitization enables financial services firms to capture valuable customer feedback and sentiment data, providing insights into emerging trends, preferences, and pain points that can inform product development, marketing strategies, and customer experience initiatives. By listening to the voice of the customer and acting on insights in real time, organizations can continuously improve their offerings and stay ahead of evolving customer expectations.

Growth in 2024 for financial services is driven by open banking, CDP adoption, and call center digitization. And we’ve already seen firsthand from our banking and wealth management clients how embracing these trends and leveraging the power of technology, data, and customer-centricity, organizations can unlock new opportunities for innovation and differentiation.

0 Comments