Quoting commercial group health insurance policies is a complex endeavor in today’s health plans. Unlike Medicare or an individual or family policy, where benefits are pre-defined and quoting is usually a simple matter of referring to rates based on locality or age cohort of the individual(s) to be insured, group quotes are complicated. From start to finish, they can take up to a week just to gather the information and prepare the quote.

The standard tools are not up to the challenge of providing many quotes per day during the busy season, yet health insurance providers have idle time in the off-season because volumes are low. Could they put their time to better use by pre-configuring their network and underwriting data during the off-season so that they could provide quoting on-demand during the busy season? The answer is a definitive “YES” with Quote-to-Cash solutions like Salesforce CPQ integrated into your Salesforce Sales Cloud.

In this article, we’ll first explain the problems haunting the typical process behind group quote generation; then we’ll delve into a better, simpler solution with Salesforce CPQ; and finally, we’ll examine the benefits from integrating with Quote-to-Cash solutions.

The Problematic Standard Way

Typically, an appointed, independent Agent of Record (AOR), who works with the business on their insurance needs, will start the process by contacting an in-house agent at the health plan provider for a quote. Working together, they will gather the group census demographics and required information about pre-existing conditions that could affect the quote.

Next, the in-house agent will prepare documents for the internal underwriting and pricing teams, that often includes different individuals and teams to represent different network models (HMO, PPO, EPO) and benefit types (medical, dental, vision, pharmacy) for underwriting analysis and pricing.

Upon completion of these analyses, the information is bundled back together into a quote document that can take up to a day to prepare. Next, a round of approvals may take a day or two. During the hectic fourth quarter, these teams scramble to generate hundreds of quotes for businesses as large as 10,000 and as small as three covered lives.

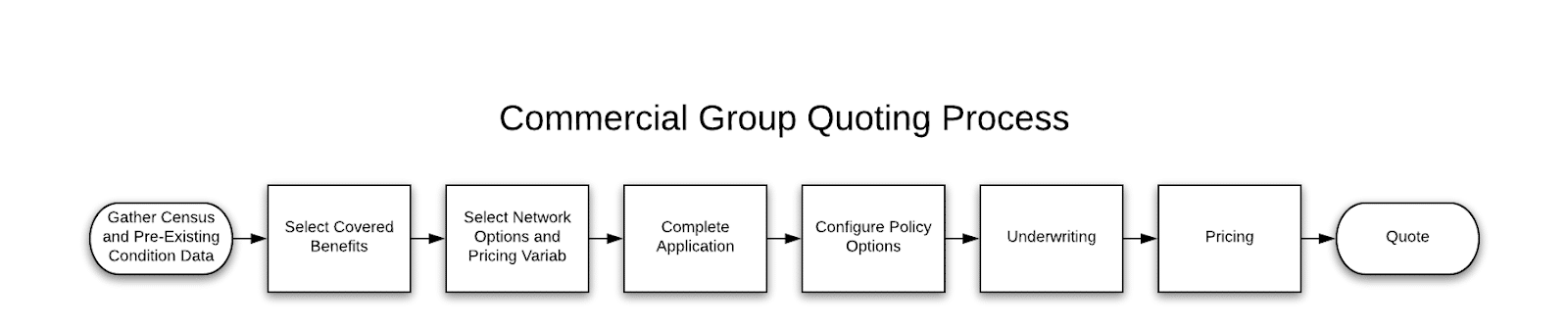

Here’s a flowchart showcasing the lengthy process:

Even when simplified, the group policy quoting process is still complex and arduous.

The process is so complicated because of…

Want to keep reading? Download the ebook, The Complete Guide to CPQ for HLS, today!

0 Comments