The great big shift toward technology in financial services is not front-page news—but success stories of fully digitally transforming in the industry may be. Even before the pandemic, the pivot for financial institutions was encroaching, as JPMorgan Chase loudly proclaimed to investors in the fall of 2019 “We are a technology company.” Customers’ digital savviness has only increased exponentially since then with the additional acceleration of the pandemic pushing many onto platforms they had never used before. Customer expectations, standards, and wishes are contingent on a strong digital tech approach, and financial services are in the thick of figuring out their place in that space.

To find their answers, decision-makers in the financial services industry can take several cues from the prominent success stories of the tech industry as an example of transforming business with digital services and closer customer engagement. In this article, we’ll focus on four of those crucial lessons:

Explore avenues for more digital services in your business

The first step financial services can take to mirror the winning strategies of big tech leaders is a bit obvious: go digital. If you haven’t already, launch a company-wide strategy to explore digital avenues your business can expand into and build a better presence in. What services typically done in-person at your offices or bank branches could more easily be done digitally, allowing more flexibility to both your team and your customers?

Many institutions in the industry are taking this time to branch into more FinTech opportunities, and it’s not without good reason. “FinTechs are creating new customer-centric ways of accessing and delivering financial services, from convenient ways to make payments to investing money with robo-advice and creating a personalized budget with the help of an app,” according to Professor Anne-Laure Mention, Director of the Global Business Innovation Enabling Capability Platform at RMIT University. “Done well, the process of financial innovation can bring significant benefits to our broader society.” Digital services powered by the right technology and foundational platforms can extend beyond merely transactional and help customers with more advanced services such as mortgage financing. However your organization reimagines the future, be sure it includes a heavy emphasis on digital.

Make strategic partnerships to accelerate data

What better way for financial services to learn from tech companies than to partner directly with them? Financial institutions can prioritize partnerships with digital leaders in the tech space and through these strategic partnerships lend more contextual data to their own digital initiatives. New data inputs from technology partnerships can accelerate your credit management practices, enhance integration, and tap into more digital commerce buyer trends.

Sometimes the technology partnership you need is simply allowing cashflow access to the top payment providers customers are using. When a customer’s bank plays nicely with a variety of payment options, it makes daily life easier on customers and makes them feel like their bank is in tune with their needs. Over 90 percent of banks in the US are already poised to partner with Stripe for the launch of its new product, Financial Connections, which allows customers to speed up transactions with the applicable banks. It’s little things like this that can make all the difference for showing your customers you care about the ease and speed of their personal finances.

Engage with customers on all fronts

Another crucial lesson from the tech sphere is mastering the art of omnichannel engagement with customers. For financial services, this means making more dynamic experiences on all social media platforms, building out chatbot and SMS communication options with AI, and potentially developing a mobile app for users to use as their hub for all things related to your business. However, more than just ticking off all the boxes of every channel your organization needs a presence on, making the engagement on those channels is where the real ROI comes in.

Financial services organizations that emphasize consistency and personalization across all their customer touchpoints are the ones that see real results from an omnichannel engagement strategy. Users should feel the tone and UX of every application, platform, or communication is consistent in its messaging and consistent in its personal knowledge of the user. If a customer has to repeat the same concern or question five times on different channels to reach you, you have a consistency problem. Integrating your omnichannel avenues with a single source of customer data and truth can pave the way for that seamless experience that keeps customers content and loyal.

Prepare delivery models for new digital services

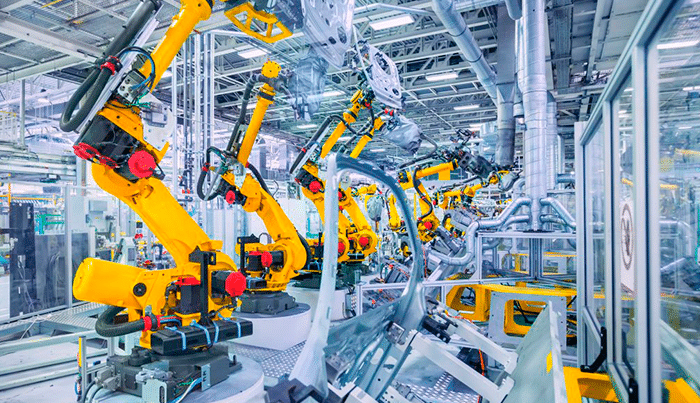

Finally, all these lessons will be for naught if financial services don’t take one last cue from the tech space: you must be ready to deliver with the right skills, tools, and resources on board. It’s possible your organization will need to hire new team members to carry the responsibilities of digital engagement successfully, or you can pivot existing team members’ workloads so they have the information and skills necessary to manage digital engagement. Whatever you do, be wary of treating the human tasks of digital engagement as a small thing that can be forced into your existing structure. True digital transformation takes dedicated resources and workloads ready to engage with customers and make good on the promises made through digital channels.

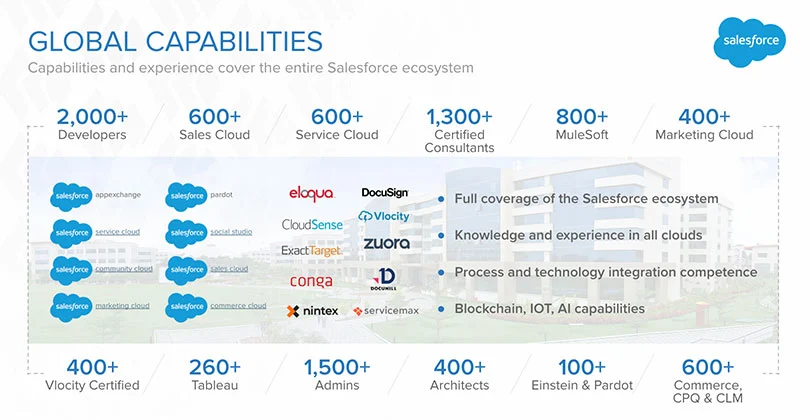

In addition to setting up your internal personnel structure for optimal digital engagement, financial services benefit immensely from streamlining their internal processes with automation tools. Digital process automation with Salesforce can take a variety of menial tasks off the plate of your staff so they have more time to be strategic and personal in their interactions with customers. Common financial workflow orchestrations can also be expertly automated with the Salesforce platform to make other critical functions easier for both your team and the customer, such as opening new bank accounts, disputing flagged transactions, and putting new offerings on the market faster.

Financial services have every reason and tool in front of them to make incredible business transformations that will delight current and attract new customers. And Simplus is an expert, proven partner to make sure the transition is seamless. Reach out today.

0 Comments