In 2019, the First American Financial Corporation reported that over 885 million financial and personal records linked to real estate transactions were exposed through a typical website design error.

Earlier this year, American and Southwest Airlines reported that hackers stole personal information relating to around 8,000 pilot applicants and approximately 2,000 Allied Pilots Association members from a central database.

Could your business be next?

A recent IMF survey found that over half (56 percent) of central banks surveyed by the International Monetary Fund need a cyber strategy for the financial sector of their business.

“Fintech provides users with quick and easy access to financial services. Whether it’s making a payment, checking an account balance, or applying for a loan, users expect a fast and frictionless experience,” says Victor Martin, a fintech expert. “This expectation is only growing as more fintech companies enter the market, each trying to outdo the other in terms of convenience.”

However, when companies push convenience, it often comes at the expense of security. “The easier it is for users to access their financial information, the easier it is for cybercriminals to do the same,” said Martin. “Fintech companies must balance this trade-off to ensure users can access their financial information quickly and easily without sacrificing security.”

Banking customers enjoy the convenience of accessing banking information and making online purchases from anywhere at any time. But to provide such convenience, organizations offering financial services must ensure their customer and business data is secure.

As AI continues to gain prominence, it is more vital than ever for companies competing in the Financial Services industry to stay informed about the latest developments and possibilities.

Our upcoming ebook, The Future is AI: Secure Data and Customer Trust in Financial Services, is a gateway to understanding how AI is redefining risk assessment, personalizing customer experiences, optimizing trading strategies, detecting fraudulent activities, and reshaping regulatory compliance.

Through expert insights and real-world case studies, we will explore the opportunities and challenges AI technology brings to the financial table. We’ll also examine how the synergy between human intellect and machine intelligence can elevate financial services to unparalleled heights while addressing the ethical considerations of leveraging such powerful technology.

Experts estimate that around 54 percent of the financial services industry uses cloud computing. However, Venkat Malladi, cofounder and CTO at Vymo says adoption needs to increase to keep pace with the demand.

“With the sheer amount of data that the industry will be handling, it is imperative that the remaining 46 percent board the bus,” Malladi says. “As banks and insurance companies seek to respond quickly to regulatory changes and respond to customers with agility and insight, they need faster and easier access to data, which is not something native to non-cloud infrastructure.”

AI technology has become crucial in enhancing data security and safeguarding sensitive information within the financial services industry. In this ebook, we cover several ways AI contributes to strengthening data security, including:

Advanced Fraud Detection

AI-powered algorithms can analyze vast amounts of transactional data in real-time, identifying unusual patterns and behaviors that could indicate fraudulent activities. Along with Behavioral Biometrics and Anomaly Detection, these systems continuously learn from historical data, improving their accuracy in detecting and preventing fraud.

Access Control

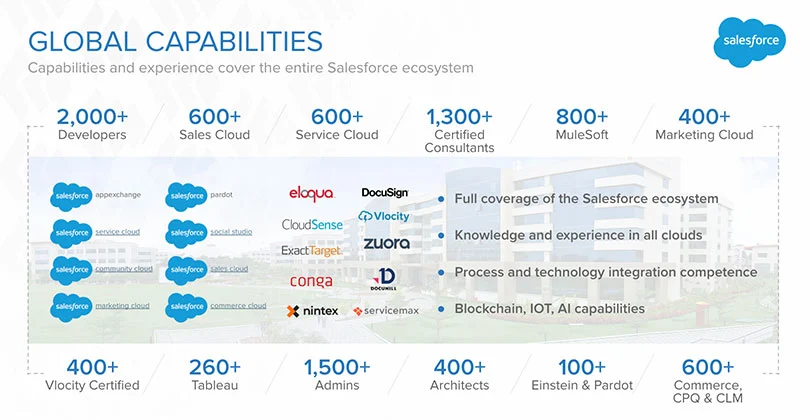

Working in partnership with the Salesforce system, AI technology can implement dynamic access control measures, granting or revoking access to specific data based on user behavior, location, and other contextual factors. This reduces the risk of unauthorized access to confidential data.

Predictive Security Analytics

AI technology can predict potential security threats and vulnerabilities by analyzing historical data and current trends. This proactive approach allows financial institutions to take preventive measures before a security breach occurs.

Natural Language Processing (NLP) for Monitoring

NLP-powered AI systems can monitor communication channels, such as emails and chat messages, to detect potential security breaches or data leaks, thereby reducing the risk of data exposure.

Secure Data Sharing

Using AI technology enables secure data sharing between financial institutions and third-party providers, using techniques like homomorphic encryption to protect data while allowing collaborative analysis.

Adaptive Security Infrastructure

Implementing AI-driven security systems can adapt and respond to evolving cyber threats, staying one step ahead of cybercriminals and ensuring data security remains effective over time.

By harnessing the power of AI technology, financial services organizations can significantly improve their data security measures, instilling confidence in their customers and partners while keeping cyber threats at bay.

At Simplus, we understand that a comprehensive security strategy must combine multiple layers of defense to create a robust and resilient data security infrastructure without compromising the customer experience.

Our solutions transform how our financial services clients connect with customers and drive innovation. If you are ready to optimize the capabilities of AI technology, let’s chat.

0 Comments