By the end of the year, a new revenue recognition standard known as ASC 606 will start to be phased in, and it’s going to fundamentally alter how businesses report their revenue. Revenue will be recognized at precisely the time that goods and services are delivered to the customer, and the recognized revenue will need to accurately reflect the consideration to which the businesses are entitled. Many legacy software solutions that businesses have relied on for years and even decades will not be capable of making the transition to the ASC 606 revenue recognition standard. Indeed, when businesses have complex revenue recognition features such as subscriptions, multi-year contracts, and recurring-revenue relationships, they will need to either invest in a modern CPQ (Configure, Price, Quote) system that can keep track of contracts that change mid-cycle and that don’t necessarily follow simple, linear lifecycles, or, modify existing legacy systems to handle the changes.

We are constantly being asked why businesses should upgrade to a CPQ system that’s compatible with ASC 606 compliance goals. That’s why the CPQ implementation specialists at Simplus have put together this article as part of a multi-part series exploring different issues that commonly come up regarding ASC 606 compliance. In the first post, we explored five essential things that every company with complex revenue recognition processes needs to understand. In this post—the second of our five-part series—we explain why you need a modern, robust CPQ system (if you don’t already have one!) to achieve your ASC 606 compliance goals:

We are constantly being asked why businesses should upgrade to a CPQ system that’s compatible with ASC 606 compliance goals. That’s why the CPQ implementation specialists at Simplus have put together this article as part of a multi-part series exploring different issues that commonly come up regarding ASC 606 compliance. In the first post, we explored five essential things that every company with complex revenue recognition processes needs to understand. In this post—the second of our five-part series—we explain why you need a modern, robust CPQ system (if you don’t already have one!) to achieve your ASC 606 compliance goals:

1. You need to automate your revenue recognition process: Under ASC 606, revenue recognition will move farther up the sales pipeline, from ordering and invoicing to agreements and quotes. Thus, when you have complex revenue recognition processes such as subscriptions and recurring-revenue relationships, you must be able to dynamically reallocate and modify valuation as these contractual agreements change. The only way to do this reliably and cost-efficiently is through automation. Modern CPQ systems are designed expressly to automate your revenue recognition in a way that provides consistency, transparency, and a comprehensive audit trail.

2. You need to integrate contracting with invoicing and billing: CPQ systems do more than just provide automation for the early stages of revenue relationships. By managing the contracting stage, they also drive invoicing and billing, which are, of course, instrumental to being able to rectify revenue recognition data from the contracting stage—and ultimately to driving ASC 606 compliance. When set up correctly, a modern CPQ system can become your authoritative source for recognizing revenue as your performance-based contract obligations are met.

3. You need enhanced cross-departmental collaboration: Because ASC 606 will require you to recognize revenue at the moment goods and services are delivered to the customer, your front-facing sales teams will need to start working more closely with your back-office invoicing and accounting teams. If they’re working on disconnected systems, you’re setting them up for frustration, wasted time, and the possibility of recurring errors. A modern CPQ solution will put everyone on the same system, paving the way for enhanced collaboration and improved efficiency.

4. Sales commissions need to be aligned with revenue recognition practices: If you have a sales commission structure, it’s probably linked closely to your customer contracts, which means that under ASC 606 you are obligated to align employee commissions to the moment when revenue is actually earned. In many cases, this requires you to track complex capitalization and amortization features of your contracts. CPQ can take care of all of these accounting steps for you—automatically and in real time, even as your contracts change mid-cycle.

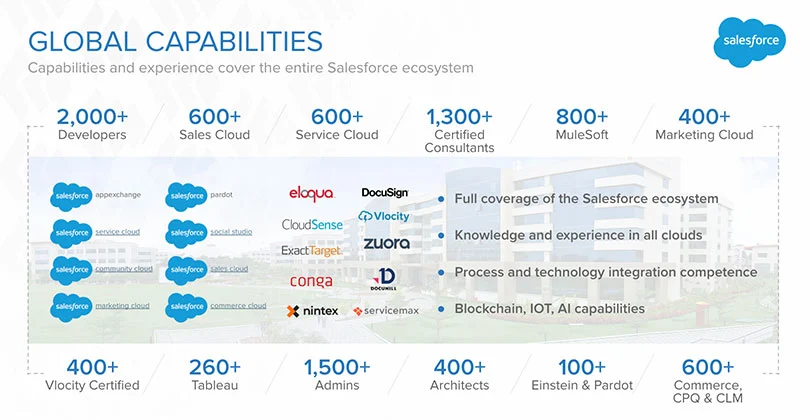

ASC 606 has created a strong business case for investing in a modern CPQ tool, but ASC 606 also makes good business sense—regardless of the compliance issue. When you invest in a CPQ system like Salesforce Quote-to-Cash and rely on the implementation expertise of Simplus, you can count on achieving automation of your revenue recognition processes, seamless integration of contracting with invoicing and billing, enhanced cross-departmental collaboration that drives efficiencies, and management of the revenue recognition associated with any sales commission structure you might have.

Randy West is the Director of Quote-to-Cash here at Simplus. A leader in the CPQ space, Randy brings over 17 years of CPQ experience to his management of the Simplus Quote-to-Cash practice. As the former CPQ practice manager for Deloitte, Randy is the premier talent for managing CPQ resources, project delivery, and customer satisfaction.

Randy West is the Director of Quote-to-Cash here at Simplus. A leader in the CPQ space, Randy brings over 17 years of CPQ experience to his management of the Simplus Quote-to-Cash practice. As the former CPQ practice manager for Deloitte, Randy is the premier talent for managing CPQ resources, project delivery, and customer satisfaction.

To learn more about ASC 606 and how you can use the powerful capabilities of Salesforce to automate and streamline your ASC 606 compliance obligations, reach out to us at Simplus today.

0 Comments

Trackbacks/Pingbacks