As the globe continues to brace itself and read headline after headline about the year’s eventual plummet into a recession, to say all eyes are on banking and financial institutions is, well, a gross understatement. Consumer patience is running thin, and expectations are rising high.

Financial services, as a whole, has a lot at stake if each organization wants to maintain its customer base and trust.

At the start of this year, we identified three key capabilities for the fintech industry to stay current and keep pace with industry trends. These included automation, personalization of customer engagement, and anticipation of customer needs. Now, halfway through the calendar year, we can start to see how fintech companies are tackling these core capabilities, especially in light of growing economic uncertainties, and how it’s impacting the market overall.

Automation of recurring actions

The evolution of financial institutions continues to follow the ever-changing demands of customers, whose expectations are only rising and preferring far more tech-savvy communication mediums from their banks, insurance providers, and investments. Whether it’s apps, sleek websites, or integrated chatbots on social media, it’s unlikely that the bulk of your customer interactions will happen in person, if at all.

We’ve seen more financial services providers pivot their focus to more and more automation to make this expectation a lived reality across their offerings. Using automation to manage the intake of customer questions, requests, and repeat tasks is a no-brainer. The distinction comes down to what financial services providers are leveraging the right automation tools to be that split second speedier than their competitors. Because with the rising generation’s expectations, every second counts and can make all the difference.

What we’ve also noticed halfway through the year, however, is that the other key ingredient to all this automation—which is still a definite must—is the magic of keeping some human touch behind the scenes. Customers want what they want and they want it now, naturally, and that’s why automation is still critical, but customers are also drawn to a financial services institution to begin with because of more human interactions, whether it’s to receive personal financial advice, sign for a major loan, etc., some things are still just better in person for the end consumer and can make a lasting impression that makes for a long-lasting customer relationship.

Personalization of customer engagement

Part of keeping humanity in financial services despite automation is making sure as many customer interactions as possible are personalized to the individual customer. We see this trend continuing hand in hand with the drive for automation in our client engagements thus far this year.

A single positive and personalized interaction with a financial institution goes a long way in bolstering long-term customer loyalty and word-of-mouth brand awareness. And digital platforms provide the perfect medium to spread personalized interactions far and wide to your customers, wherever they may be.

Customers can discover unique experiences, catered to their financial profile, goals, and needs, through digital mediums like apps, wearable devices, QR codes, etc. The fintech companies that explore personalized experiences on all digital platforms will be ahead of the game in this rapidly changing landscape. Because ultimately, personalization helps you drive retention and satisfaction for customers, which translates into steady dependable growth for your bottom line.

Anticipation of customer needs

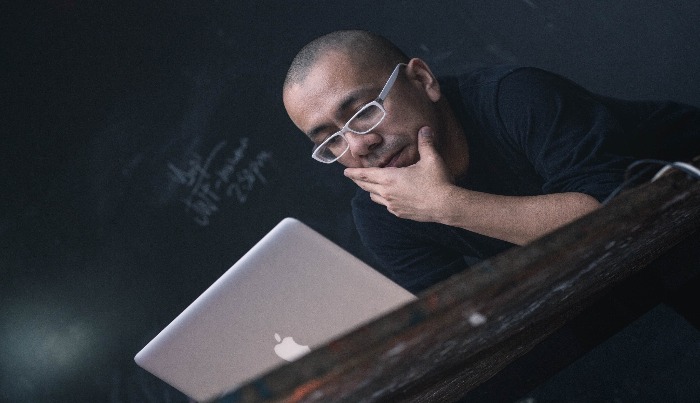

Finally, we continue to see the trend of AI take off in technology planning discussions. It’s an exciting future, as outlined here, but it’s important to be realistic and practical about what can and can not be done in the here and now. If foundational technology processes and digitization projects aren’t taken seriously now, the AI excitement we’re all anticipating will never take flight. Or it will, but it won’t get very far off the ground.

Synthetic data is a specific area of AI use for fintech that is generating a lot of excitement lately. Essentially, it means creating a proxy data set, powered by AI, to behave the same as a real-world data set and fill in existing data gaps. This has the potential to speed up software testing, promote more advanced analytics, and get new banking products to market without having to wait for the data to be there. Synthetic data is a compelling AI use case that may be more viable and available to some financial institutions now than many other AI use cases.

So while we too are excited to leverage a growing availability of AI use cases and better anticipation of customer needs with virtual assistants and AI-powered agents, we also recognize the importance of maturing your tech stack according to the realities and requirements of now so that you’re ready for the eventual AI future of tomorrow.

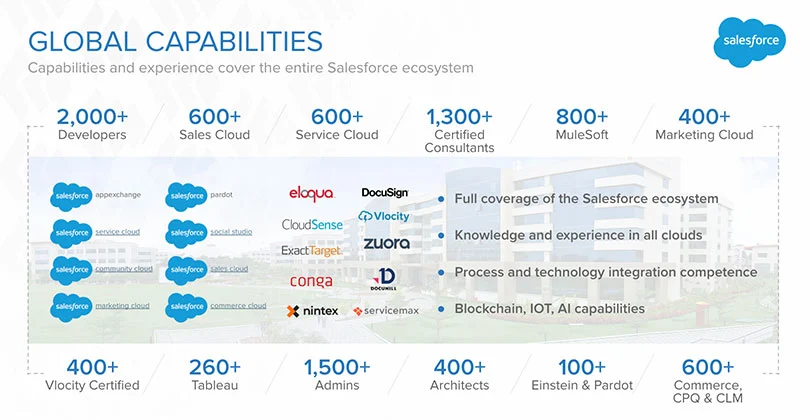

We’d love to help your organization better understand and implement solutions with these capabilities in mind. Meet with our financial services leads and schedule a time to discuss how our industry-focused consulting services can bring your tech stack to the next generation.

0 Comments