Payers often get caught up in the administrative side of doing business that they forget that the patients are the members they need to care about. So as insurers face the pressure to deliver convenient access to information and personalized services, this growing need may leave payers wondering how they can scale their operations and maintain healthy revenue flow and control costs while satisfying a customer’s need for 24/7 access and digital-based services.

Paging, digital transformation.

Digital transformation is designed with customer-centric innovations in mind. It helps payers keep customers as the primary focus of their business by achieving three key points:

- Identifying customer needs,

- acknowledging the need to streamline day-to-day tasks and infrastructure, and

- simplifying those processes to improve internal operations, elevate customer expectations and optimize revenue growth.

Let’s discuss each point:

Identify the need

The bottom line for payers to increase revenue through premiums and cut down on costs is to ensure their members stay healthy. Fewer trips to the doctor mean fewer claims, fewer payouts and bigger profits on premiums.

Digital transformation helps direct your company’s focus on health-centric initiatives. When insurance companies promote good health among their customers, they can also launch programs related to care management, preventative medicine, long-term care-related services like therapeutics and other programs.

But most legacy systems can’t deliver segmented data to help guide valuable resources where customers can most benefit. Using technology to host a deeper dive into data opens up opportunities for informed decision-making.

“By harnessing the power of data analytics, insurers can gain insights into customer behavior, claims trends and other areas that can help to inform decision making,” explained Maya Rice-Boshi. “In addition, the use of predictive analytics can help insurers to identify risks before they occur, allowing them to take proactive measures to mitigate those risks.”

Expanding services is auspicious–unless you try to grow with an outdated infrastructure. For example, implementing a robust CRM with customized automated features meets customer expectations while also serving your internal customer by digitizing essential processes.

Acknowledge payer day-to-day responsibilities

Experts project spending for insurance technology in the US and the United Kingdom to increase by more than 25 percent by 2026. The focus of this investment includes digitizing core capabilities, expanding self-service digital tools and improving personalized customer service.

Essential tasks can be time-consuming and repetitive when handled manually. Still, with automation, payers can easily deliver customer-centric administrative services, such as automatic notifications for signature requirements for surgery approval or special approval for a claim, without getting bogged down by large volumes of administrative work.

This expansion in service capabilities allows payers to continue serving members and better manage programs that streamline the day-to-day tasks, such as pre-approvals on surgeries, referrals, claims appeals, grievance management, and claims and billing management.

Automated digital, cloud-based technology also helps your teams seamlessly manage the unique features of an expanded provider network and overall provider management that navigates varied service delivery models.

In other words, as your company grows (and research shows the insurance industry will grow this year), digital transformation is designed to enhance the functionality of your infrastructure to adapt to those sometimes complex and often rapid changes in customer expectations and service options.

Simplification

If the orchestration of a business is simplified, your internal customers are happier, healthier, and more satisfied within their work environment. And you’ve created an infrastructure that enables the company to grow further and serve more people differently.

“As the financial sector becomes more commoditized, customers want insurance options that are differentiated such as use-based (like motor insurance for fleet management) and on-demand (one-off use for traveling or using ride-hailing service),” said Salesforce experts.

With digital innovation, data models are customed to different aspects of the business. So if you’re trying to handle member care with care management, payers have a separate data model—available right out of the box—that can help versus trying to manage within the provider network manually.

For instance, users can link one data model to another and create a comprehensive profile of member needs and available resources. With this model, payers can leverage automation and workflows and build these end-to-end operations within cloud technology.

With digital technology, customers can consider the new segmentation of products and services instead of relying on a one-size-fits-all operation. Now, your company can identify segments of the population that can benefit from specialized services within a particular region or community for different people.

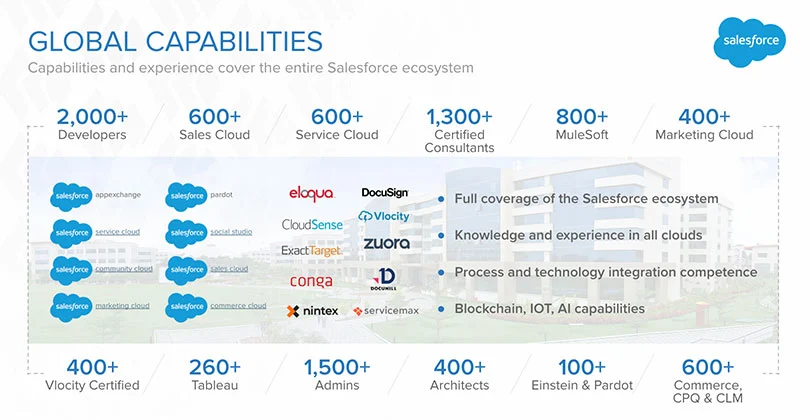

By leveraging Salesforce-based technologies, our team can simplify complex operations with innovative cloud technologies designed with your long-term goals in mind.

At Simplus, we are inspired by your goals to deliver customer-centric experiences. We also recognize that the quality of support you deliver to customers depends on the value you place on empowering your team with innovation that contributes to a healthy work environment, job satisfaction, and productivity.

0 Comments