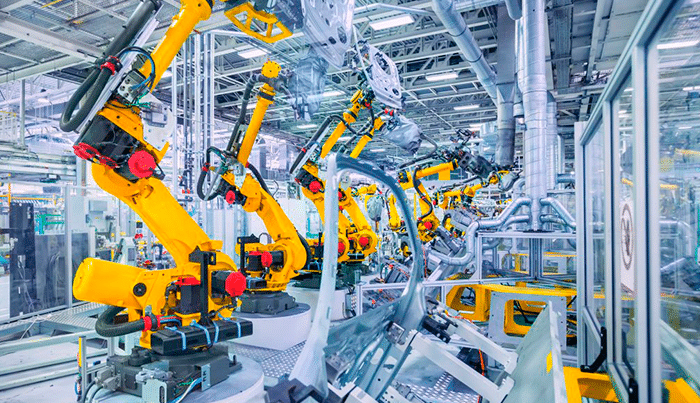

As 2024 draws to a close, it’s time to reflect on the seismic shifts that have occurred within the manufacturing industry over the past year. From the rise of digital tools designed to streamline sales processes to evolving strategies around rebate management and the ongoing battle for better product line visibility, this year has been marked by an accelerating pace of change. Manufacturers have had to adapt quickly to new technologies, evolving customer demands, and an increasingly complex global landscape. Here, we take a deeper look at three key trends we’ve been monitoring all year that shaped the industry in 2024.

Manufacturers turned to CPQ and more comprehensive RevOps tools repeatedly

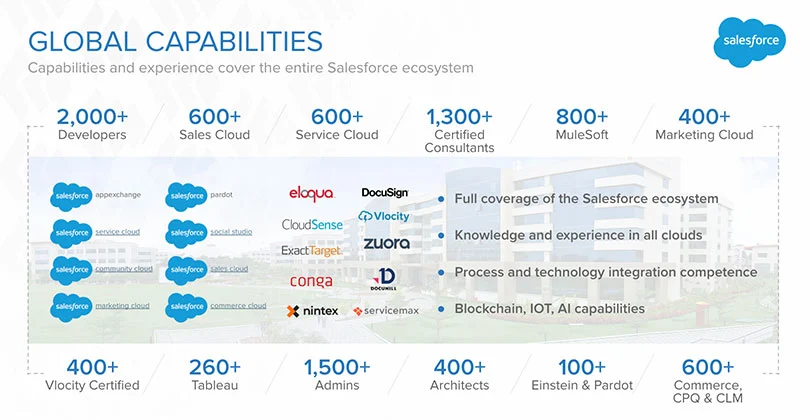

Complex sales cycles have long been a challenge for manufacturers, particularly in industries like industrial equipment, high-tech electronics, and automotive. In 2024, however, a significant shift occurred as more manufacturers turned to Configure, Price, Quote (CPQ) software and comprehensive Revenue Operations (RevOps) tools, like Salesforce’s Revenue Cloud, to streamline and optimize these complex, multi-step sales processes.

Historically, manufacturing sales teams faced lengthy, error-prone manual quoting and pricing processes that were often inconsistent and dependent on spreadsheets or legacy systems. This slow, fragmented approach was a significant pain point for sales teams and customers alike, resulting in missed opportunities and longer sales cycles. However, by implementing CPQ systems, manufacturers could not only automate and speed up pricing and quoting but also ensure accuracy and consistency across different regions and product lines.

What truly changed in 2024, though, was the integration of these CPQ tools with broader RevOps platforms. Salesforce Revenue Cloud, for example, offered manufacturers a comprehensive suite of tools that connected the dots between sales, finance, and customer success. This integration allowed companies to have a clearer view of the entire revenue cycle, from lead generation to post-sale renewals. Revenue Cloud, which includes CPQ as well as contract lifecycle management, billing, and revenue recognition capabilities, helped manufacturers manage not just sales but the full spectrum of revenue-generating activities in a more unified, data-driven way.

This move toward more integrated systems was motivated by a need for speed, flexibility, and improved customer experience. The ability to configure complex products on the fly, generate quotes instantly, and access real-time pricing intelligence helped manufacturers win more deals faster, while also ensuring that they remained agile enough to adjust to changing market conditions. As more companies realized the value of these tools, they became central to the sales strategy, resulting in shorter sales cycles, higher win rates, and increased revenue per customer.

Rebate management continued to be a quiet source of revenue prowess

Rebate management, though often overlooked, has quietly emerged as one of the most effective ways for manufacturers to optimize revenue streams. In 2024, many manufacturers started recognizing rebate management as a key component of their broader revenue strategy, one that can have a significant impact on profitability. These programs, which provide financial incentives to distributors, retailers, or customers for meeting certain purchase or sales targets, have long been used to incentivize loyalty and boost sales volume. However, many companies were not fully aware of the potential value in optimizing their rebate processes.

Salesforce, with its suite of cloud-based tools, was a major enabler of this change. Its tools allow manufacturers to track, manage, and analyze rebates in real time, providing detailed insights into how rebate programs were performing across various channels and customer segments. The integration of rebate management into the broader customer relationship management (CRM) ecosystem meant that manufacturers could seamlessly incorporate this important revenue driver into their sales processes.

In 2024, we saw more companies begin to leverage Salesforce’s tools to not only automate rebate calculations but also to gain deeper visibility into rebate claims and program compliance. By using automation, manufacturers could reduce the administrative burden, minimize errors, and ensure that they weren’t leaving money on the table due to inefficiencies or missed opportunities. Moreover, advanced analytics and AI-driven insights allowed businesses to fine-tune their rebate strategies for maximum impact, ensuring that they aligned with broader business objectives and improved overall profitability.

What was once a “back-office” function is now a central piece of revenue optimization, with manufacturers increasingly relying on digital platforms to drive better decision-making and increase the effectiveness of their rebate programs.

Product line visibility remains an ongoing struggle for many manufacturers

Despite the numerous advancements in digital tools and processes, product line visibility remained an ongoing struggle for many manufacturers in 2024. This issue is particularly significant in industries with complex, multi-layered product portfolios, where tracking everything from raw materials to finished goods in real time can be a logistical nightmare. As global supply chains become more fragmented and the demand for personalized products increases, manufacturers are increasingly looking for ways to get better insights into their product lines, both internally and externally.

The struggle is rooted in several factors. For one, many manufacturers still rely on disparate systems, such as legacy Enterprise Resource Planning (ERP) software or disconnected databases, making it difficult to access real-time product data across various departments. Secondly, the growing complexity of product offerings—think customization, configuration, and bundling—has only increased the need for greater visibility into how products are designed, produced, and delivered.

In 2024, many manufacturers turned to digital twins, IoT solutions, and advanced analytics to improve visibility. These technologies allow manufacturers to create a digital replica of their physical products and processes, enabling them to monitor everything from the production line to the end customer. While these technologies are still in the early stages of widespread adoption, they are already proving valuable in providing greater transparency and improving decision-making. Agentforce AI, too, holds compelling potential use cases for improving product visibility in manufacturing.

Despite these advancements, the road to achieving full product line visibility is still long and fraught with challenges. Data silos, inconsistent reporting practices, and the inherent complexity of global supply chains all continue to impede progress. Manufacturers will likely continue to invest in new technologies and strategies to address this issue in the coming years.

The manufacturing industry in 2024 has been defined by a greater focus on digital transformation and operational efficiency. From the widespread adoption of CPQ and RevOps tools like Salesforce Revenue Cloud to the recognition of rebate management as a powerful revenue tool, manufacturers are finding new ways to optimize and accelerate their processes. At the same time, the struggle for better product line visibility remains an ongoing challenge, one that will require continued investment in technology and data integration in the years to come. As we move into 2025, one thing is clear: the manufacturing industry is in the midst of an exciting, digital-driven evolution that will shape its future for years to come.

0 Comments